What is an In-Kind Donation? A Complete Guide For Churches and Nonprofits

In-kind donations are given to virtually every nonprofit organization. But despite their popularity, they are also one of the most misunderstood types of donations churches receive.

This post is a complete guide on the topic of in-kind donations. We’ll define what they are, give examples, discuss pros and cons, and everything in between.

What is an In-Kind Donation?

An in-kind donation is a type of charitable giving in which, instead of giving money to buy needed goods and services, the goods and services themselves are donated.

In-kind donations can also be referred to as:

- Gifts in-kind

- Non-cash donations

- Donations-in-kind

- In-kind contributions

We recently recorded a video about in-kind donations that took a deep dive into the subject. Watch it here:

Examples of In-Kind Donations

In-kind donations can either come in the form of goods or services. Below are examples of in-kind goods and in-kind services:

In-Kind Goods Examples

- Canned food for the soup kitchen

- Old clothes for the coat closet

- A box of lightbulbs for the foyer

- A computer for the church office

- Chairs, tables, and other furniture

In-Kind Services Examples

- Repairing the church van

- Rewiring the light switches in the fellowship hall

- Fixing the leaky bathroom faucets

- Building a new website for the church

- Sharing accounting services, legal services, or other professional services for church members

What's the Difference Between In-Kind Goods and In-Kind Services

What separates an in-kind service from a donation of goods is time and expertise. When a church receives an in-kind service, it's because a member provided their professional services for free. Many in-kind services provide a church with intangible items, like a website. However, tangible items may also be part of the donation, like plumbing parts if a plumber replaces piping in the church building.

Recording the Value of In-Kind Donations

Recording in-kind donations is different than cash donations and knowing that difference is very important.

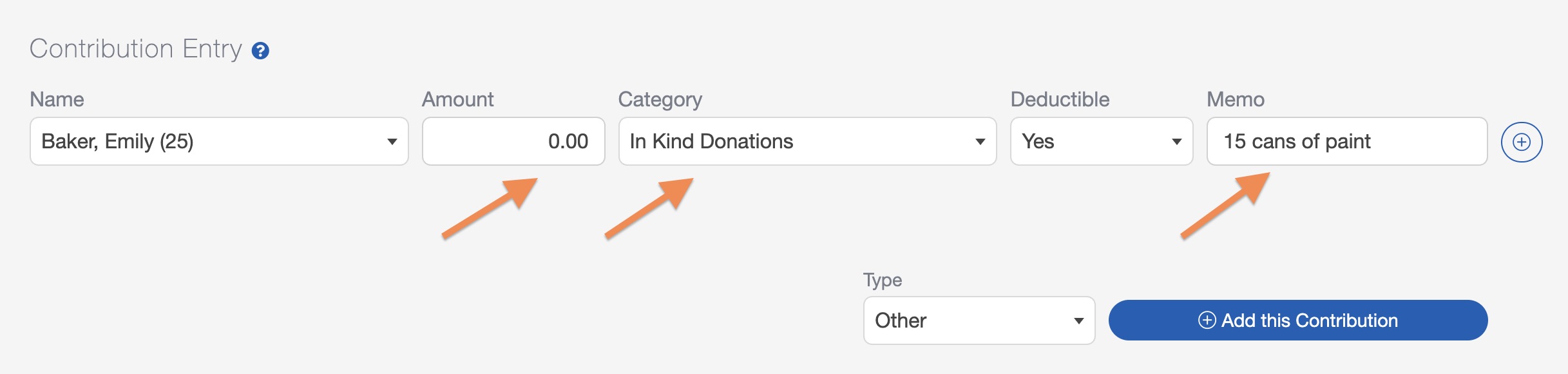

One of the biggest misconceptions about recording in-kind non-cash donations is how to record the value of an in-kind donation. Per IRS rules, the donor determines the value of a non-cash contribution, not the church. Churches should only report these in-kind donations as $0.00. The donor must fill out a Form 8283 for all non-cash donations.

Below is how to report in-kind donations:

How to Report In-Kind Donations

- Log into your church management software account and begin the process of reporting a donation as you would with cash donations

- Label the donation as "in-kind". You can easily do this by creating a donation category to label all in-kind donations

- Enter the donation amount as $0. This is extremely important. You cannot enter any dollar amount when recording a donation made in-kind

- Leave a brief note or memo with a description of the donation

For the giver of the donation, they will fill out a Form 8283 when they are filing their taxes. If they have questions, direct them to this page on the IRS website for more information.

In-Kind Donation Letter

A donor may request an in-kind donation letter with an estimate of the value of their donation. This is typically for donations with a fair market value (FMV) of $5,000+. In these situations, the church still records the value of the goods or services with a zero dollar value in the ledger and contribution statement.

Note: There is a difference between the in-kind contribution statement and an acknowledgment letter with an estimate for fair market value. Some donations like land or animals require additional forms and/or letters from the IRS. When in doubt, it’s always best to consult with a local tax professional.

The Pros of In-Kind Contributions

Accepting these types of gifts enables churches and nonprofit organizations to have goods or services they need for free. This is often better and more helpful than cash gifts because the church would have to spend money out of its limited budget to pay for it.

Here are a couple of real-life examples I've witnessed to show how beneficial donations made in kind can be...

- Bob is a certified electrician and offers to fix the circuit breaker and rewire the church admin office for free. This service would have cost over $2,400 through an outside contractor. Bob’s cost of materials is minimal, it's easy for him to track the number of hours of labor, and he’s more than happy to give up his Saturday to do the work.

- Jessica owns a sign company. She donates a new front sign to the church. The retail cost for this sign is $5,500. However, her wholesale cost is $1,500. She donates it for free to the church as an in-kind donation. What cost Jessica’s company $1,500 ended up being a value of $5,500 to the church!

- Keith owns a furniture store. He decided to donate new couches to the church with a fair market value of over $3,000. The wholesale cost of those couches was $1,000. The church received 3x more value from the donation of couches than if they bought them on their own.

In-kind donations are often a simpler way for businesses to give because they don’t have to worry about their cash flow. Many companies often pay less for goods, enabling them to donate more in goods than they could in cash. Also, donating the time and service frees the church up to spend their money on other needs. In-kind donations can help ministries thrive!

The Cons of In-Kind Gifts

Not all donations are beneficial for your organization. Sometimes in-kind donations can be truly bad. Below are three types of in-kind donations churches do not want:

Donations That Are Worn Out

One of the most common donations my church received were used items from either a home or a business. Some could be refurbished with a little bit of elbow grease. Most could not.

Churches are NOT storage facilities. Vehicle donations like a car with a blown motor or a lawnmower with a broken gearbox aren't helping the church. It will be difficult for the church to sell it and they won't be able to sell it for a high enough price to be worth the trouble. Or they'll have to spend time and money to fix the issue before it can be sold.

Donations That Are Outdated

A church doesn't need the latest and greatest things to do ministry well. However, there are things that just don’t make sense anymore for churches to use. Things like...

- Old video equipment that can’t stream

- CRT computer monitors

- Obsolete computers and tablets

- Blank cassette tapes

- Outdated networking equipment

- Old software that hasn't been updated in ages

It may be tempting to accept that old upright piano from a church member. But it will need to be constantly re-tuned and it has no instrument plug-in. For the price of a few professional tunings, you could have purchased an electric keyboard that’s mobile, lightweight, and keeps perfect tune!

Outdated donations save money, but their limitations often cause ministries to have to spend double the time and energy to make them work. Often, outdated donations are just someone else’s trash that we end up throwing away.

Services Performed By Unqualified Individuals

You may have a member of your church who is a general "handyman" and can fix almost anything. They'll probably offer to fix a few broken things around the sanctuary and you'll be tempted to let them. But when it comes to having services performed for your church, they need to be done by a professional.

A botched plumbing job can turn into a bigger problem down the road. Shoddy electrical work can burn down your church. Having a service performed by someone unqualified can result in the problem becoming greater, and costing even more to have fixed by a professional. In other situations, services performed improperly can pose a serious safety risk to the church!

How to Avoid Unwanted Donations

Here's a little secret many church leaders don't know - The church is allowed to say "no" and turn down a gift. If it won't benefit your ministry, it's not worth accepting.

Also, having in-kind donation gift acceptance policies helps screen most unwanted gifts before they arrive. Read on to learn more!

In-Kind Donation Gift Acceptance Policies

Writing a donation policy or guidelines will help ensure that your church doesn’t accept donations that aren’t beneficial for your mission. Think of some questions to ask that help weed out some of these donations. Ask questions like...

- Is this donation/service something we need?

- Is this donation something we can easily resell?

- Is the person offering this free service qualified to do it?

- Does this item/service have hidden costs?

Designate a Team/Person for Accepting Donations

It’s good practice to have guidelines for who can approve of these donations. Limit your donation acceptance to a person or team that knows your mission and guidelines for donations.

Why? Your organization loses 2 big things when you don’t have a designated person or process to accept donations:

Accountability - It’s important to have accountability when accepting in-kind donations. This helps ensure that the donations are being properly recorded. Accountability minimizes the opportunity for mismanagement or fraud.

Gatekeeper - Not having a designated team or person that handles all incoming donations means that you will bring in A LOT of unwanted goods and services. A gatekeeper will help you avoid getting unwanted furniture, electronics, and other items you don't need.

Remember - The church is allowed to say "no" and turn down a gift. If it won't benefit your ministry, it's not worth accepting.

Sharing Your In-Kind Giving Policy

Having your donation policies shared publicly can help you save time, and possibly avoid awkward conversations with donors bringing undesirable gifts or services.

Share on your website. Share on social media. Make an announcement at your next event or church service.

Here are a few other examples we found that could help give you some inspiration for crafting your Donation Guidelines:

How to Ask for a Donation In-Kind

Asking for in-kind donations isn’t rocket science. Just make sure when you ask that you include these 3 things: What, Why, and How.

Here’s an example:

What you need: We need gently used and new baby clothes.

Why you need it: We are sending them to a crisis pregnancy center.

How to donate it: Donations can be brought to the church office during business hours.

You can ask for donations in multiple mediums. Maybe have an announcement slide before and after the service. Make a video to play during service and post it on social media, create a web page, and make handouts.

In Kind Donations FAQs

What does in-kind donation mean?

An in-kind contribution is any non-cash contribution. If money is donated, it is not an in-kind donation.

Why is it called in-kind donation?

Oxford dictionary defines "In-Kind" as in the same way; with something similar.

We refer to non-cash gifts as "in-kind" because they are donations meant to be similar to offering cash, but featuring the goods or services the cash would have purchased.

What is considered an in-kind donation?

Any donation of items or services is an in-kind donation.

What is cash vs in-kind donation?

Cash donations are just that...donations made with money. In-kind donations refer to any donations that are not cash-based.

How do you acknowledge an in-kind donation?

Just like you do cash donations! You add the details to their contribution statement and send them a thank you letter along with it.

However, if the in-kind gift is big or something of high value, it may warrant a special letter of thanks. But that will be up to your discretion.

Why are cash donations better?

While in-kind gifts can free up a tight budget by providing a church what they otherwise would have paid for, cash is still king. Cash donations allow for maximum flexibility, giving church leaders the ability to buy exactly what is needed when it is needed. Also, it's difficult to predict if an in-kind contribution will be what the church needs, whereas cash can be used on true necessities.

Are in-kind gifts tax deductible?

Yes, in-kind contributions can be a tax deduction for the donor. The church will record the donation as $0 and the donor must record the market value of the donation themselves when they file their taxes.

Is a gift card an in-kind gift?

Yes! Though the gift card or gift certificate has a dollar amount associated with it, it is not a cash donation. So gift cards are to be treated as in-kind donations.

The Right Tool For Recording In-Kind Donations

Recording in-kind donations, or any donation for that matter, should be quick and simple. That's what ChurchTrac is for!

ChurchTrac is the best church donation software program for handling any type of in kind donation your organization receives! It's simple, affordable, and the most user-friendly church management software out there. See for yourself how this program will help your nonprofit ministry or church with all of your fundraising needs!

|

Matt

|