Creating and Editing Accounts

You can use the Accounting feature in ChurchTrac to manage Accounts that are held at a bank or financial institution, or that are fixed assets. This includes Checking, Savings, Money Market Accounts, Credit Cards, Loans, or something similar.

Before entering transactions into ChurchTrac, you will need to add a Bank Account. This article covers how to do that.

Creating Bank Accounts

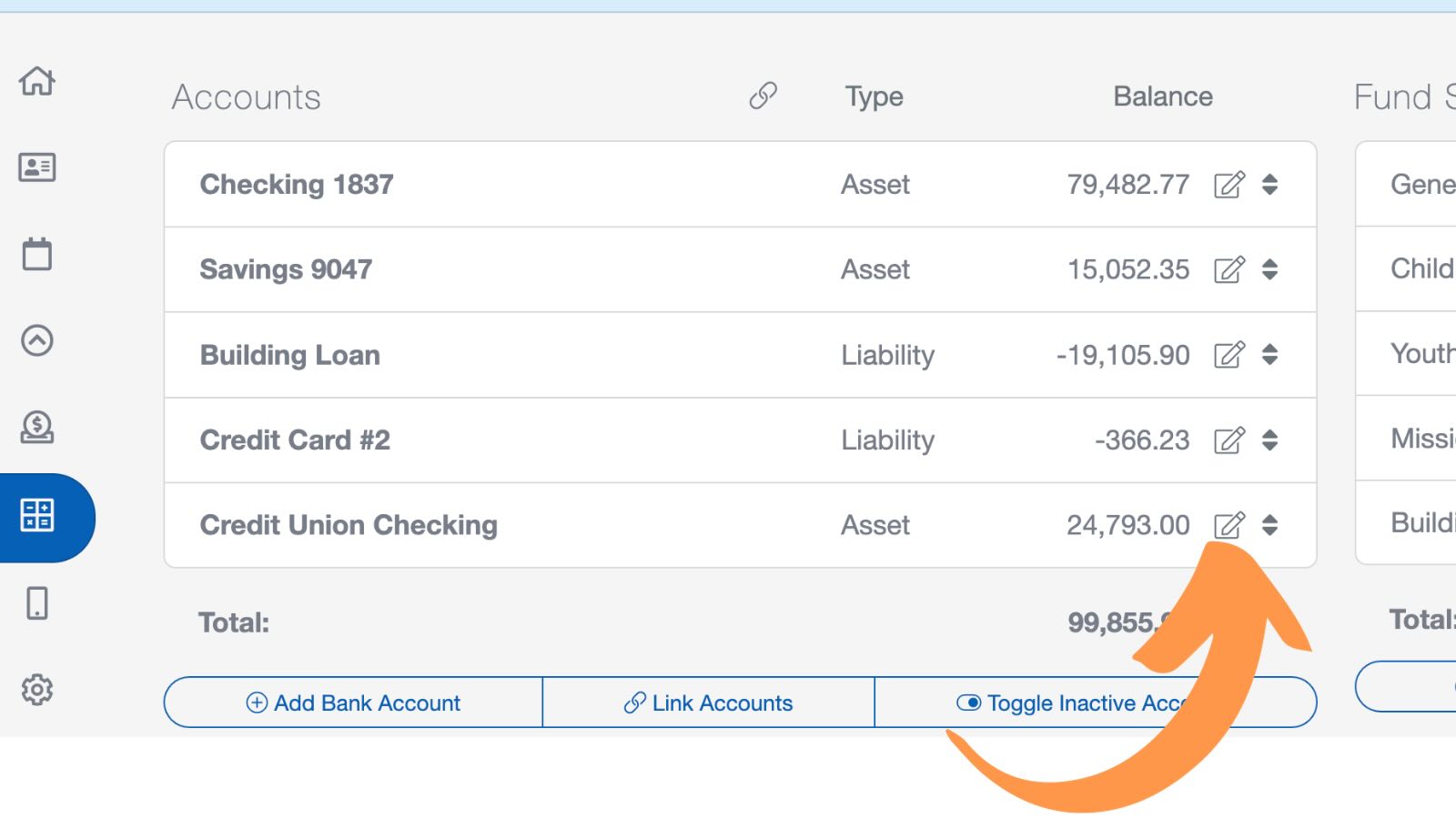

You can view, edit, and create accounts by selecting "Accounts" on the Accounting Screen page.

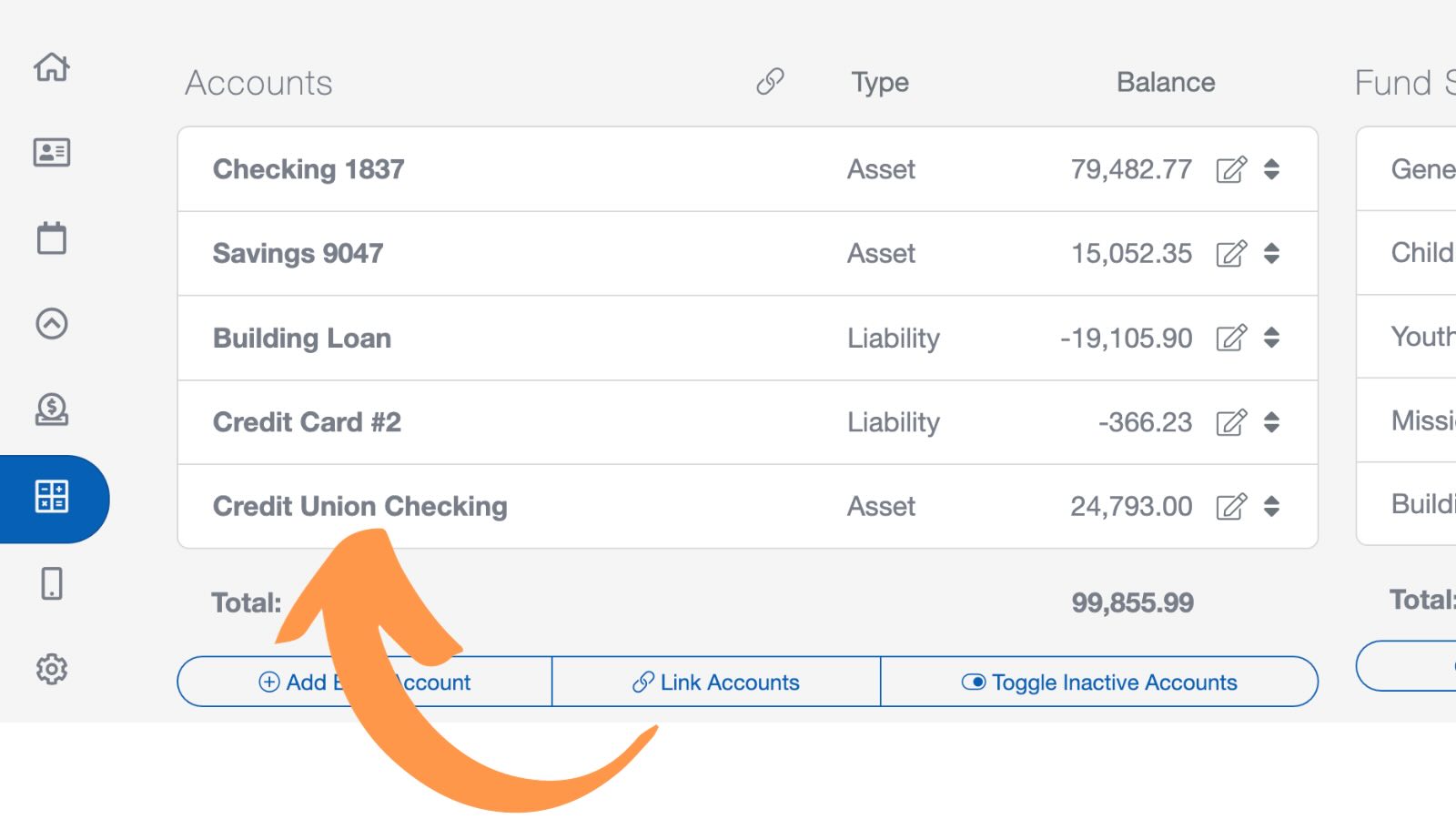

Step 1: Select "Add Bank Account"

Select "Add Bank Account" to set up a new Checking, Savings, Credit, or another Account on the ChurchTrac Accounting screen.

The flyout menu will ask if this is a financial account that holds a balance that you want to track.

Choose Yes, if this is a Checking Account, Savings Account, Loan, Mortgage, Credit Card, or the value of an asset.

Choose No, if you are trying to track or label Income and Expenses (utilities, repairs, missions, tithes, events, etc.). If so you may want to create a Category instead of an Account.

Step 2: Name and Identify Your Account

Create a unique but simple name for the account, like "Credit Union Checking." Then designate the type of Account. Choose "Asset" if this is a bank account, 401(k), property, or something else that you own. Choose "Liability" if it is a loan, credit card, or another type of debt. Choose "Untracked" if you want to record but not show on your Balance sheet or Budget. This type is ideal for mortgages, long-term loans, and fixed assets.

Once you add a name and choose the Account Type, then select "Next."

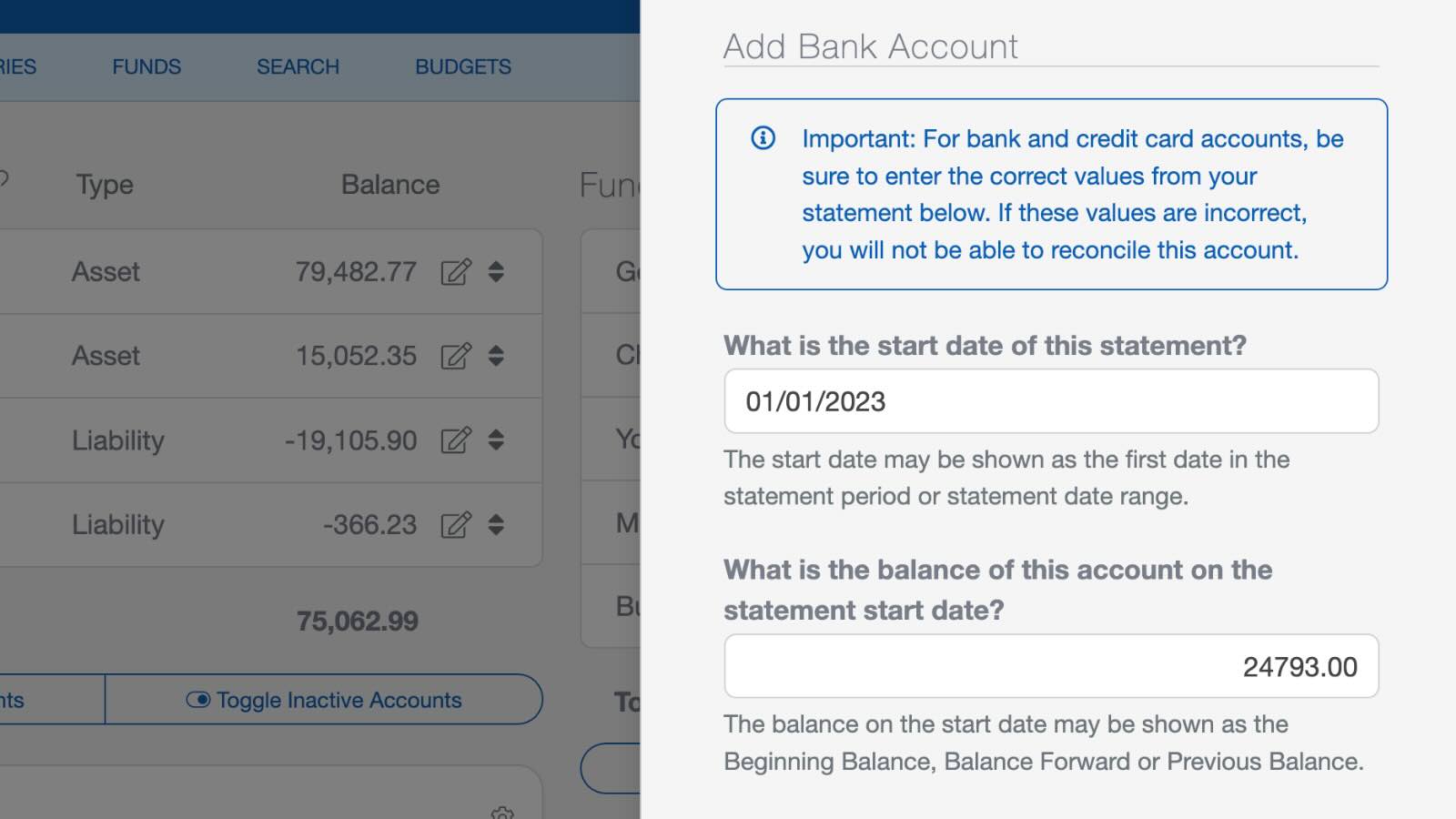

Step 3: Beginning Balance and Date

Next, enter the beginning balance and beginning date, matching your bank statement. Once entered, select "Create Account."

Your new account will be displayed in the list of accounts.

Step 4: Edit the Beginning Balance

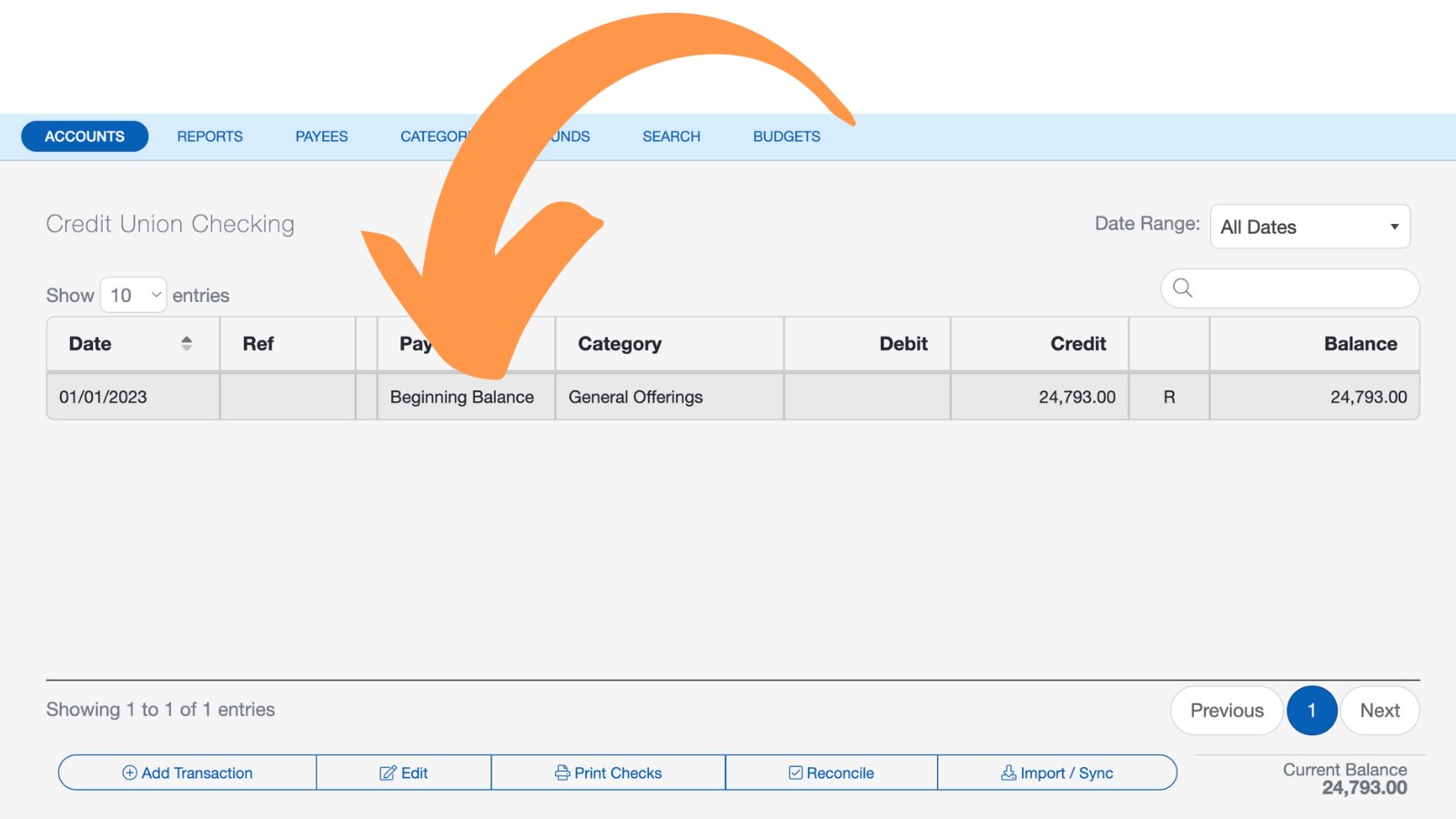

Select the Account in the Accounting page to view the register for that Bank Account.

When you create a new Account, the beginning balance transaction will be created automatically on the account register screen. An "R" will appear next to your Beginning balance transaction, indicating it has been reconciled.

However, the entire beginning balance will default to the General Offerings category and the General Fund. If any money in that balance needs to be divided into your other Funds, you will need to edit the beginning balance.

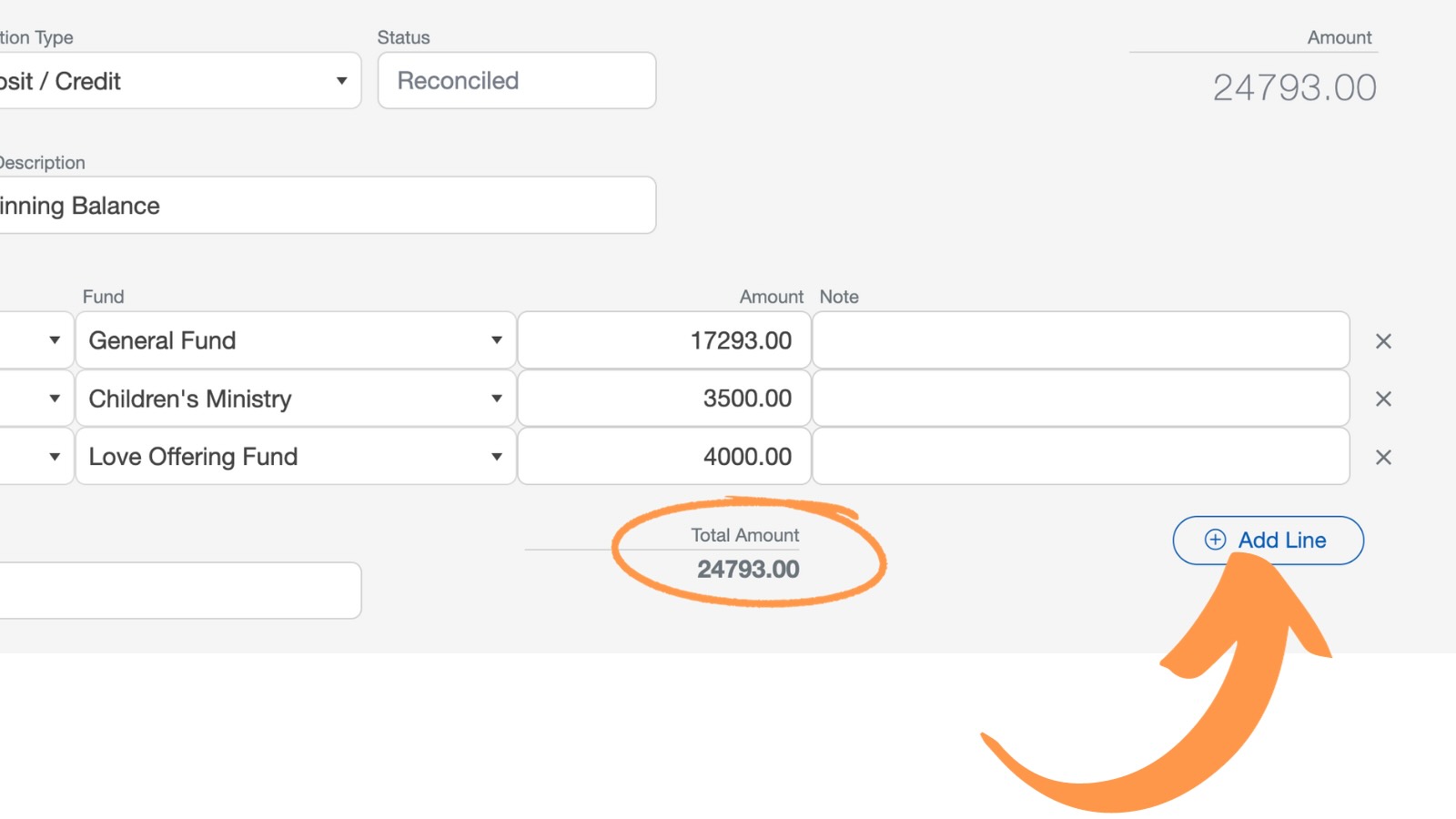

Step 5: Editing the Beginning Balance (if needed)

Either double-click the beginning balance transaction or select it once, then select the "Edit" button in the toolbar at the bottom of the screen.

In the following window, you can change the Category and Fund of the original transaction, and you can itemize the transaction by adding more lines. Just make sure the total amount remains the same as the original beginning balance as you add more lines.

Step 2: Editing Bank Accounts

There are occasions when you may need to rearrange your accounts, edit the name or status of an account, or delete an account.

Editing Account Name or Status

To edit the name or status of a church bank account, go to the Accounts page and select the "pencil icon" to the right of the account name.

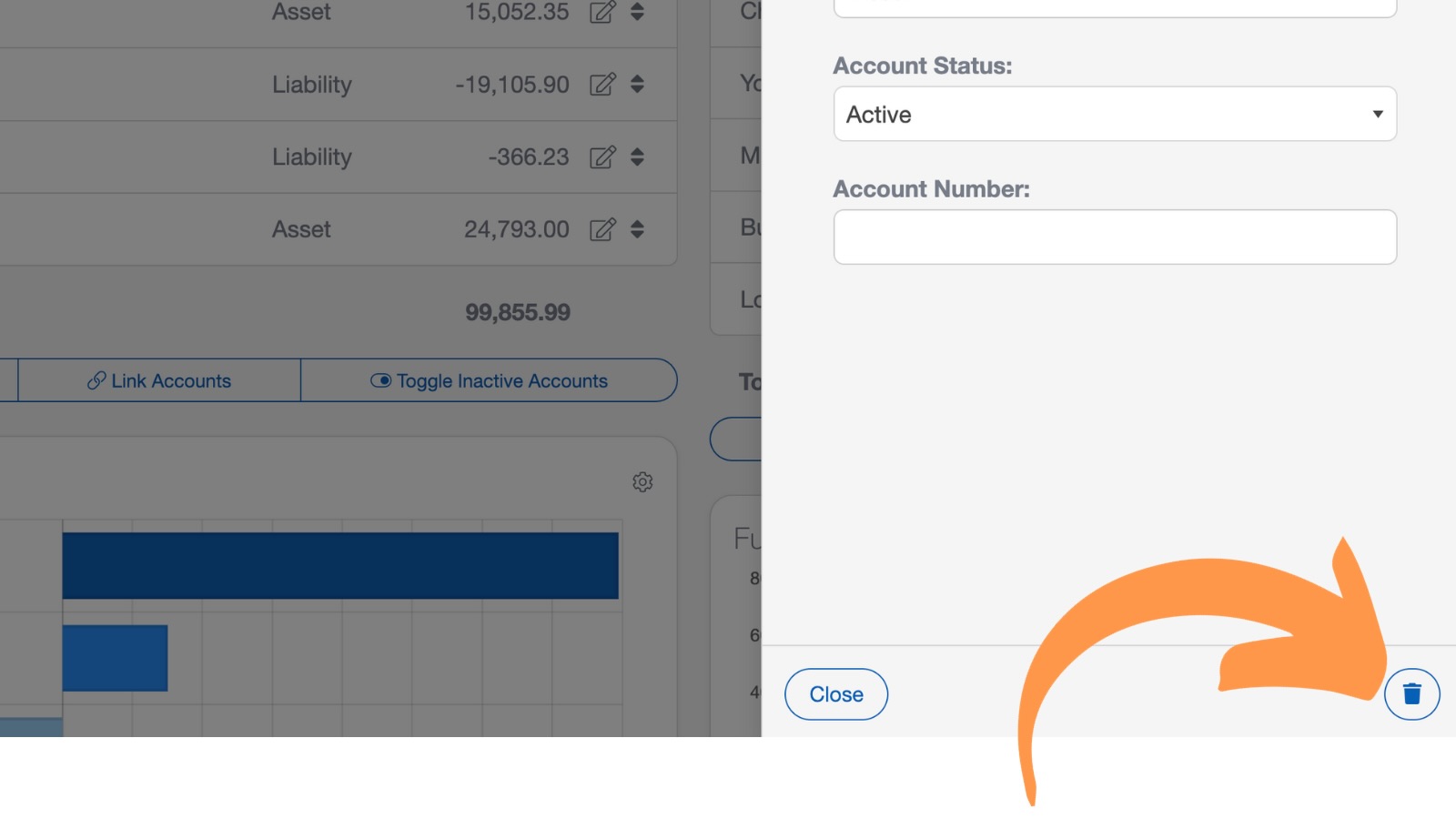

Deleting Accounts

Occasionally, you may need to delete an account. To do this, go to the Accounting Screen and select the pencil icon to the right of the account name. In the flyout menu, select the trashcan icon.

In the following window, type "Yes" and select "Delete" to finish deleting the account.

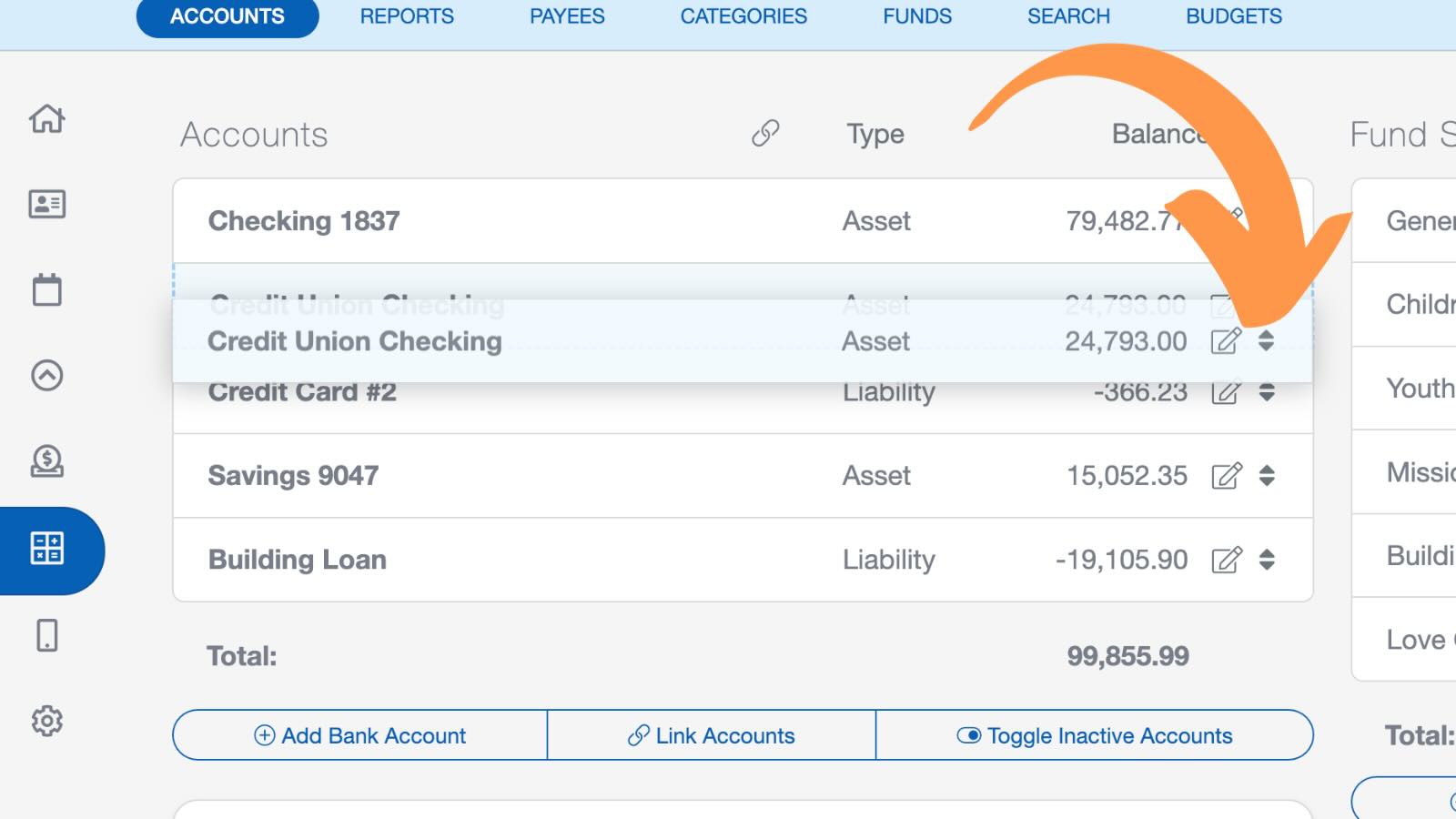

Rearrange Accounts

To change the order the accounts appear on the Accounting dashboard, select and hold the arrows to the right of the account name, then drag it to the position on the board you would like it to display.

Pro Tips

You should not add "Funds" as bank accounts here. To learn the difference between the two, please read our Basic Terminology and Examples. To learn about how to set up a Fund, see our article on Creating and Editing Funds.

Also, do not use the word 'Fund' when naming your accounts. This will prevent confusing it with a true Fund.

When creating a new account, it is strongly recommended that you locate a recent bank statement and enter the opening balance from your bank statement in the Beginning Balance field. As an example, you may want to begin entering transactions starting on January 1. However, your bank statement may not begin on January 1. In this case, go back to the previous statement and create your account using the Beginning Balance and Beginning Date from that statement. Do not create an account with a start date or balance that does not match the start date and beginning balance from a bank or credit card statement. Otherwise, your account may not reconcile or balance properly.

If you need to split your opening balance between two or more categories or funds, you'll need to edit the Beginning Balance transaction AFTER you create this account.