Importing Contributions

Using another church contribution software or spreadsheet to track your church donations? ChurchTrac gives you the ability to import church giving data from all of your donors through a CSV giving import.

Importing CSV Files

Below are the steps to import donations via CSV file:

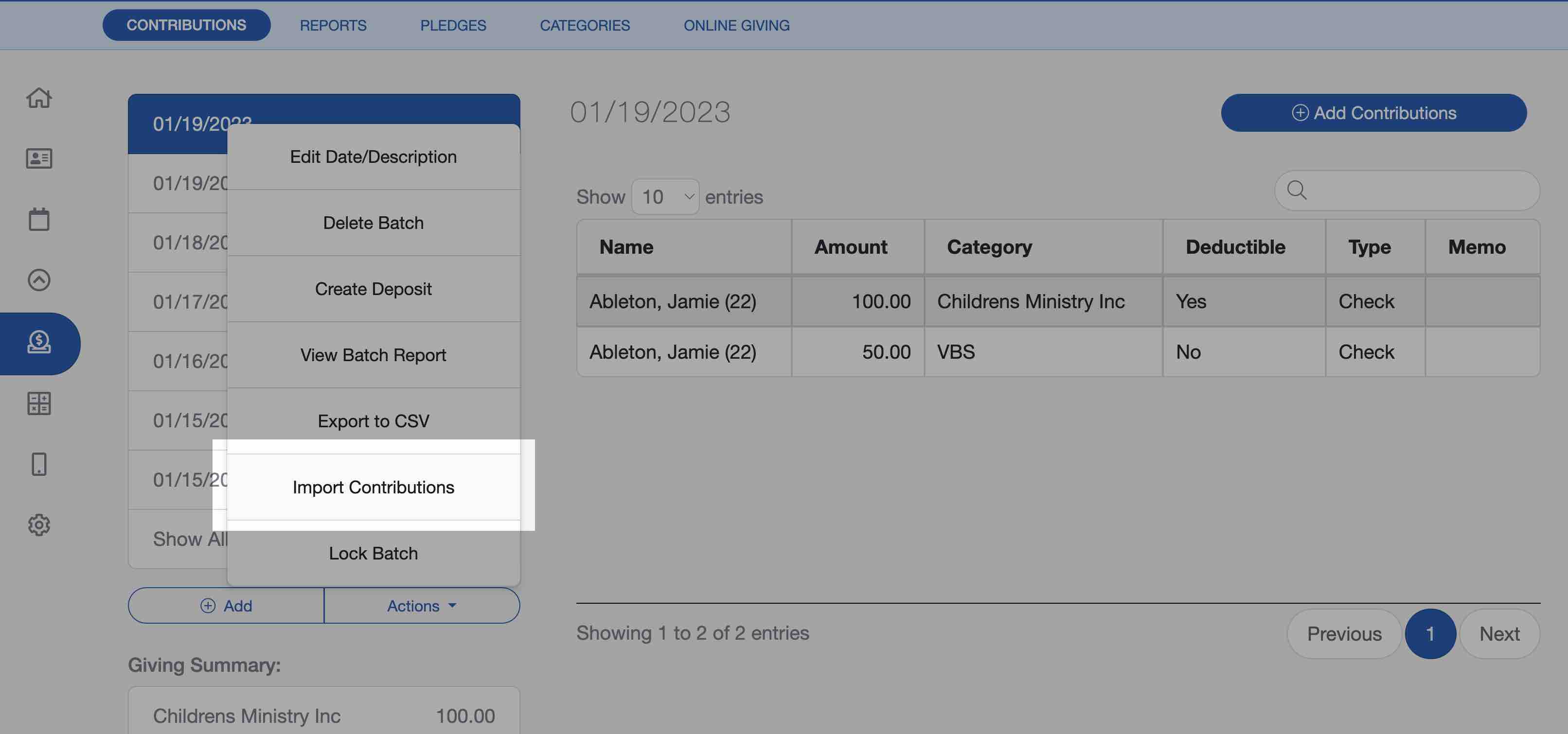

Step 1: Open the Actions Menu

To Import a CSV giving file, select any giving date and select the "Actions" button. From the dropdown, select "Import Contributions".

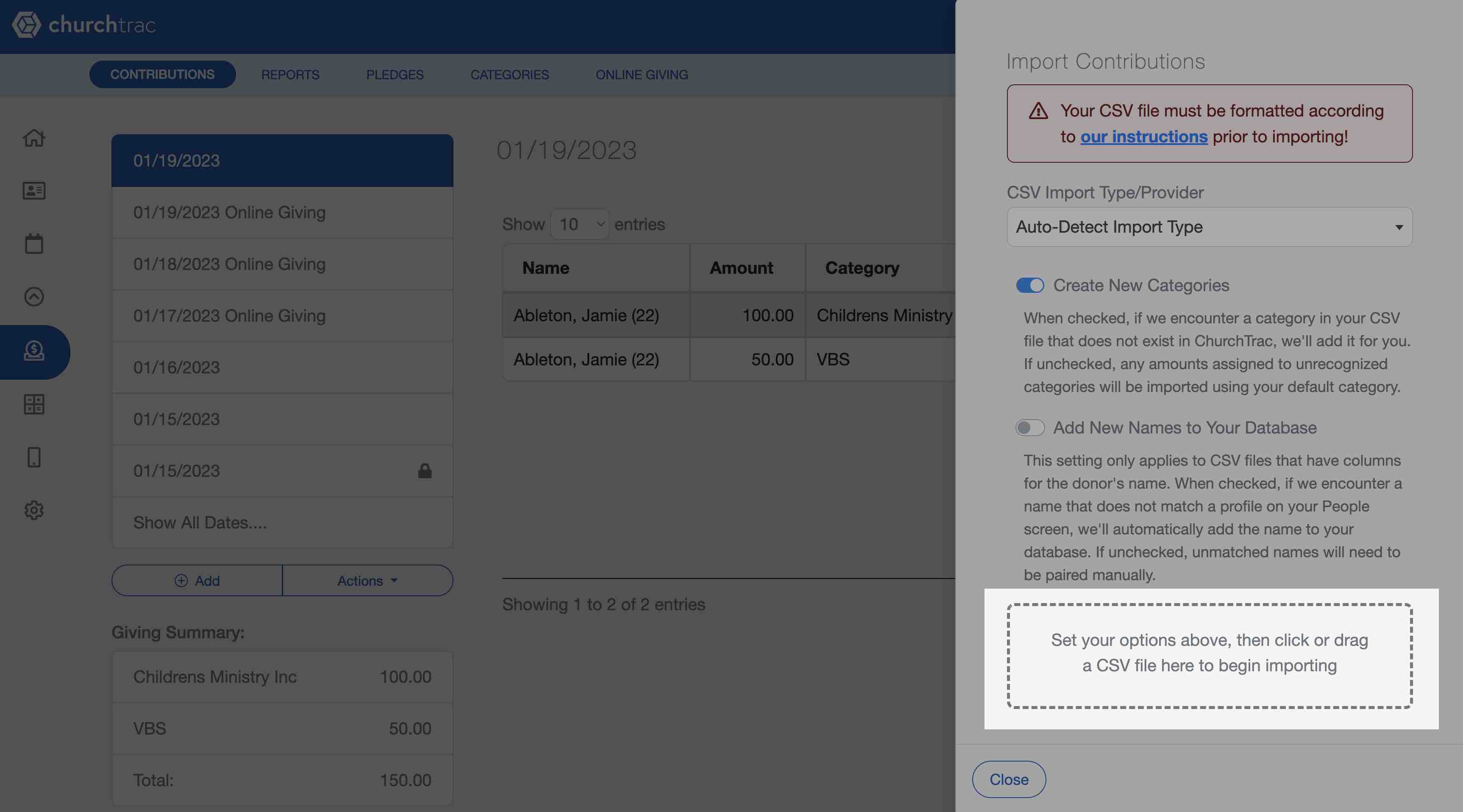

Step 2: Select a Giving Provider

ChurchTrac supports CSV files from Givelify, Paypal, Pushpay, Subsplash, and Tithely. There is no modification needed to import from these providers. If you are importing from a different giving provider, select "Manual". (Scroll down for manual import directions)

Step 3: Add CSV file

Drag and drop the CSV file from your computer files into the box at the bottom of the flyout window.

Once the import is completed, ChurchTrac will automatically create Giving Import Dates based on your CSV file. A notification will display regarding your unmatched donations or added names (if applicable).

CSV File Formatting

Before importing your church donations into ChurchTrac, here are 3 things you need to know:

- If you are importing from a spreadsheet or a provider that is not listed, you will need to select "Manual" under the Provider Type. You will first need to make sure your spreadsheet is formatted correctly using the instructions below. We've also included a Giving Import Template to help save you time. (The template is an xls file, so be sure to export it back to a CSV to import your file back into ChurchTrac)

- Each row of your CSV file will be imported as a row on your Giving screen. For each row, we need either a Member/Envelope Number or Email address to properly link the row to the correct donor in your database.

- Each row of data in your CSV file should contain a single contribution that will be applied to a single category. If a person gives a gift that is to be split between multiple categories, you should include a separate row in your CSV file for each category of the gift, just as if each entry were given separately.

Columns Format Overview

- Column A (Required) must contain the donor's Email Address --OR-- Envelope/Member number. If Column A matches someone on the People screen, then that donation will be matched to the correct profile. If the data in the first column does not match anyone on your People screen, you'll need to manually match this donation to the correct person after the import has completed. You cannot insert a person's name into this column. Do not use 0 (zero) or multiples of it as a member number. Do not leave this field blank.

- Column B (Required) must contain the amount of the donation. This column is also required. Remove any currency symbols. Do not leave this field blank.

- Column C (optional) must contain the name of the category, or category number, to which the contribution will be applied. If left blank, or if the column data doesn't match an existing category, the contribution will be assigned to the default category.

- Column D (optional) must indicate whether or not this contribution is tax deductible (yes/no).

- Column E (optional) must be any memo or notes associated with this contribution. The length is limited to 64 characters.

- Column F (optional) must be the date associated with this contribution. The date must be numeric in mm/dd/yy format (1/2/25 and not 2-Jan-25 or 2025/1/2).

- Column G (optional) contribution type. Types include "Check", "Cash", "Card", "ACH", and "Other".

- Column H (recommended) First Name of the donor.

- Column I (recommended) Last Name of the donor.