Contribution Statements In Canada

Ministries located in Canada must display their Canadian Charity ID and a signature on each contribution statement (Canadian donation receipt).

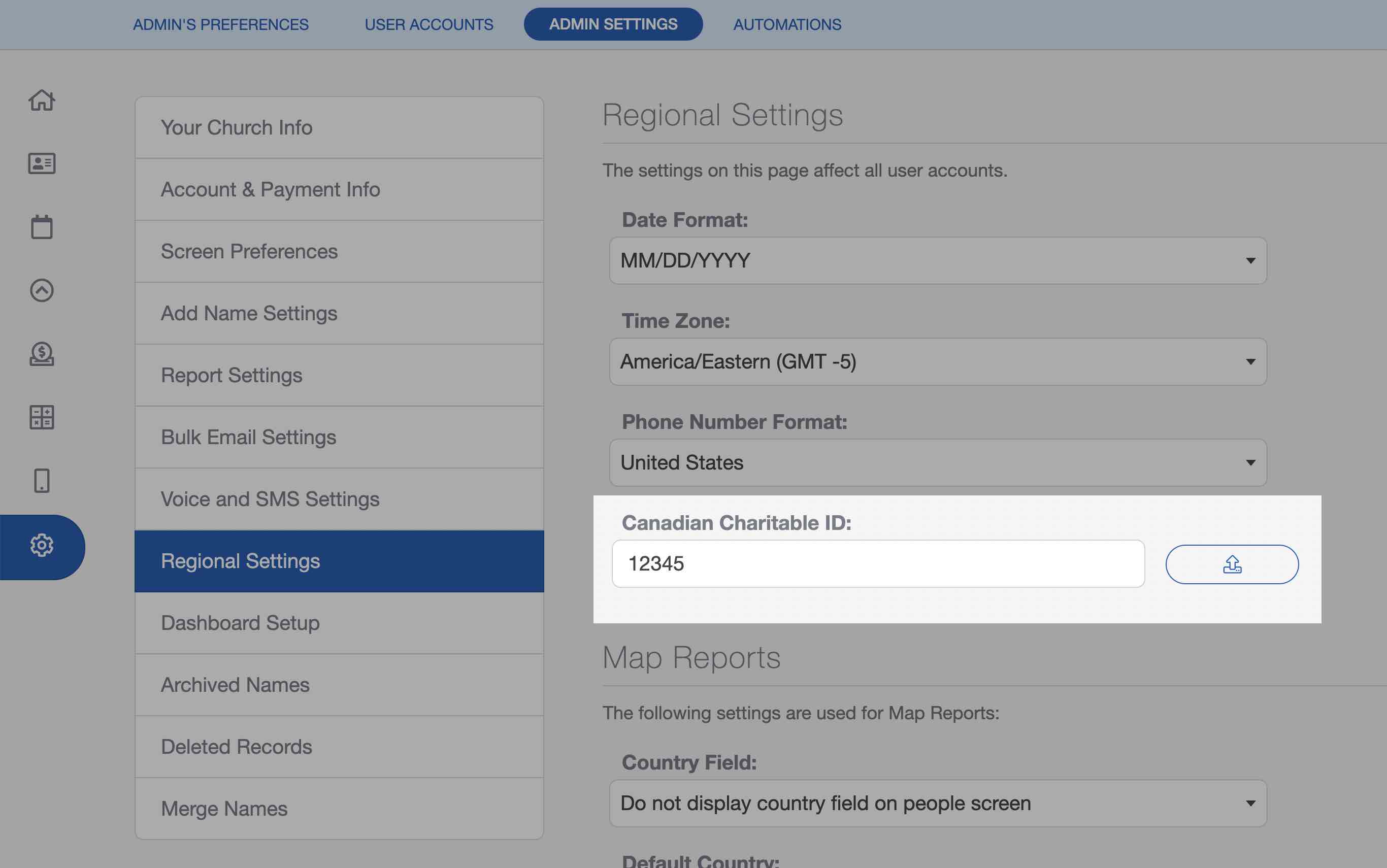

Canadian Charitable ID

To do this, insert your ID in the Regional Settings located at Settings --> Admin Settings --> Regional Settings.

After you have inserted your number, contribution statements will automatically display your Charity ID.

You also have the option to upload a signature to be automatically printed on each statement. Select the upload button (to the right of the Charitable ID field), then upload a lpg or png file of your signature.

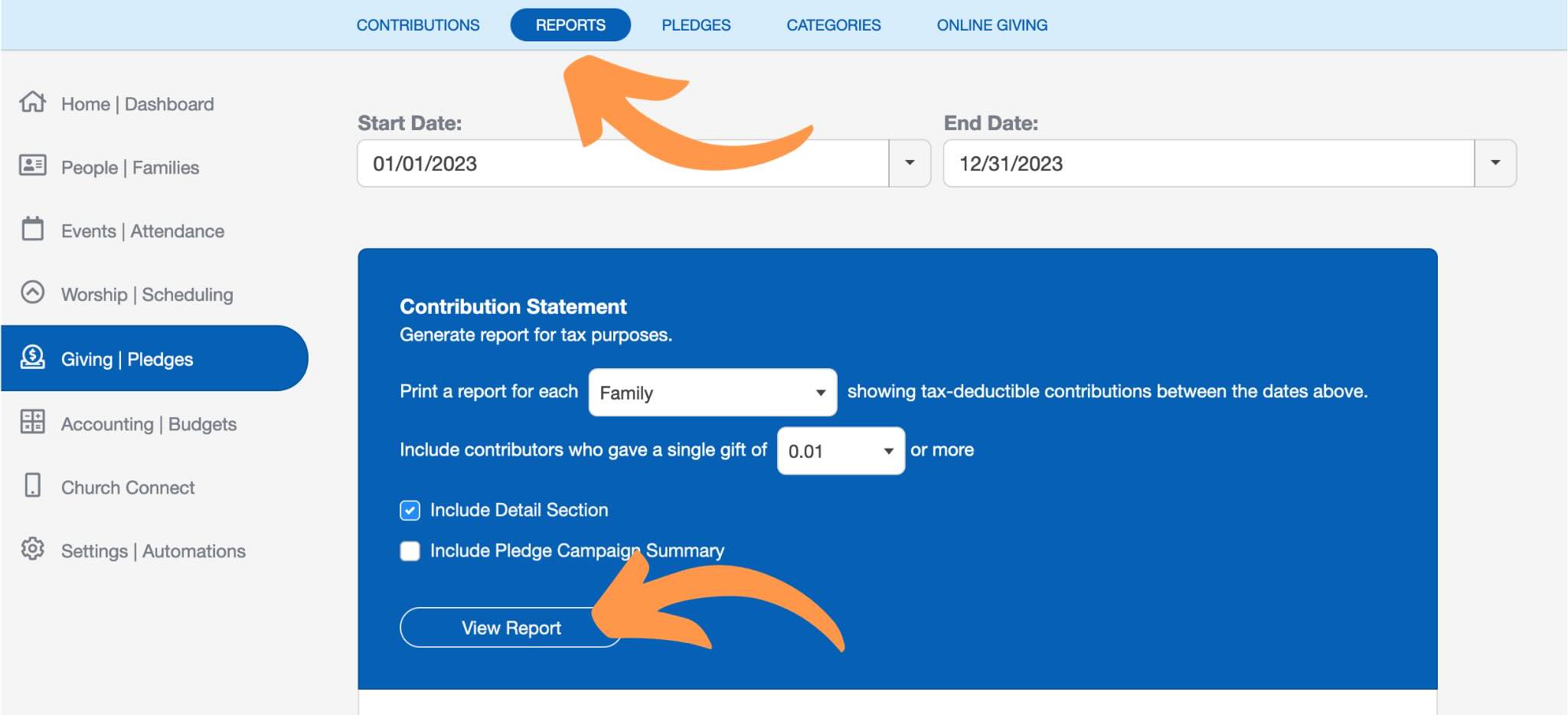

Printing Contribution Statements

Instead, you should use the Bulk Report from the GIVING Screen to generate the contribution statements. Learn more about Contribution Statements ›

After generating the report, save it as a PDF and issue each family from that saved file.The reason for this is that every time a report is generated, it creates a different receipt number, so it’s important to issue receipts directly from the saved PDF to ensure consistency.