Recording In-Kind Donations

Goods and services donated to a church are known as "in-kind donations". These church donations can often be very beneficial for churches. This article is a guide on how to record in-kind donations in ChurchTrac.

Recording In-Kind Donation in ChurchTrac

Below are the steps to record in-kind donations in ChurchTrac:

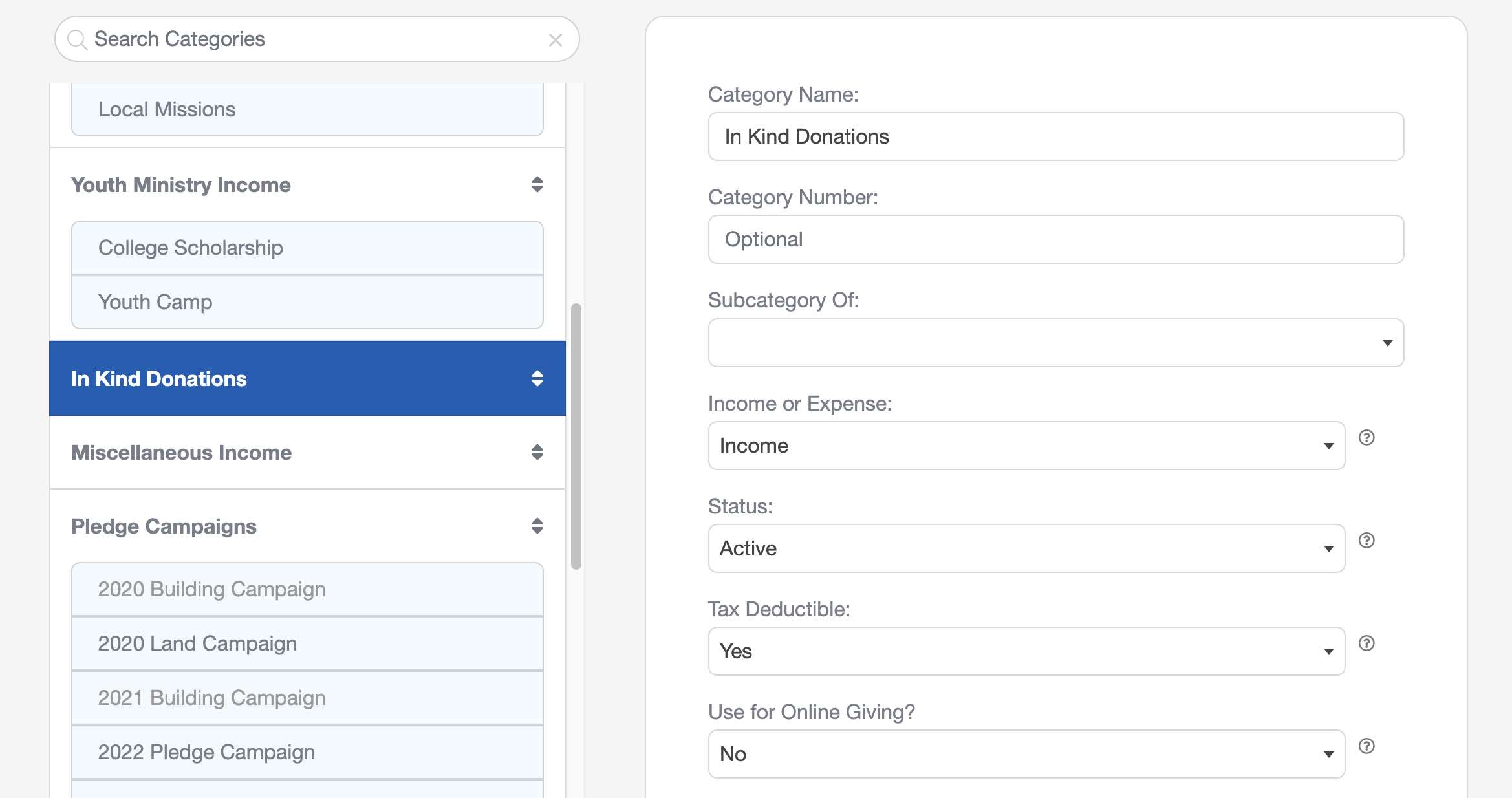

Step 1: In-Kind Donation Category

Before recording these donations, you'll need to create a tax-deductible category called "In-Kind Donation" (or some similar name of your preference).

For instructions on how to create giving categories, read the Creating Giving Categories article.

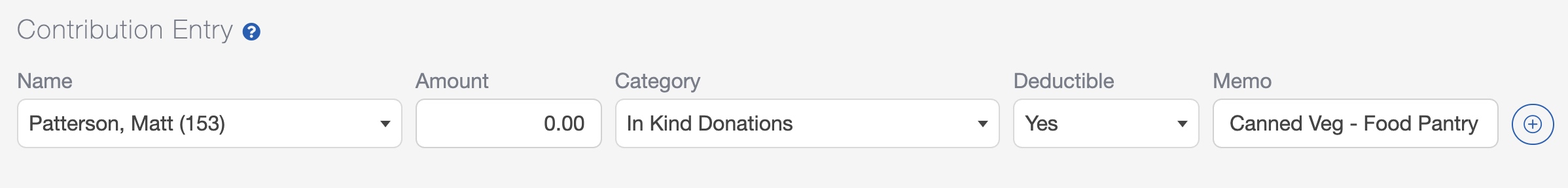

Step 2: Enter the Contribution

On the Contributions tab of the Giving screen, start a new batch and enter the transaction as a contribution with an amount of $0.00. Use the Memo field to write a description of what the item is for both your records and to display on the giving statement.

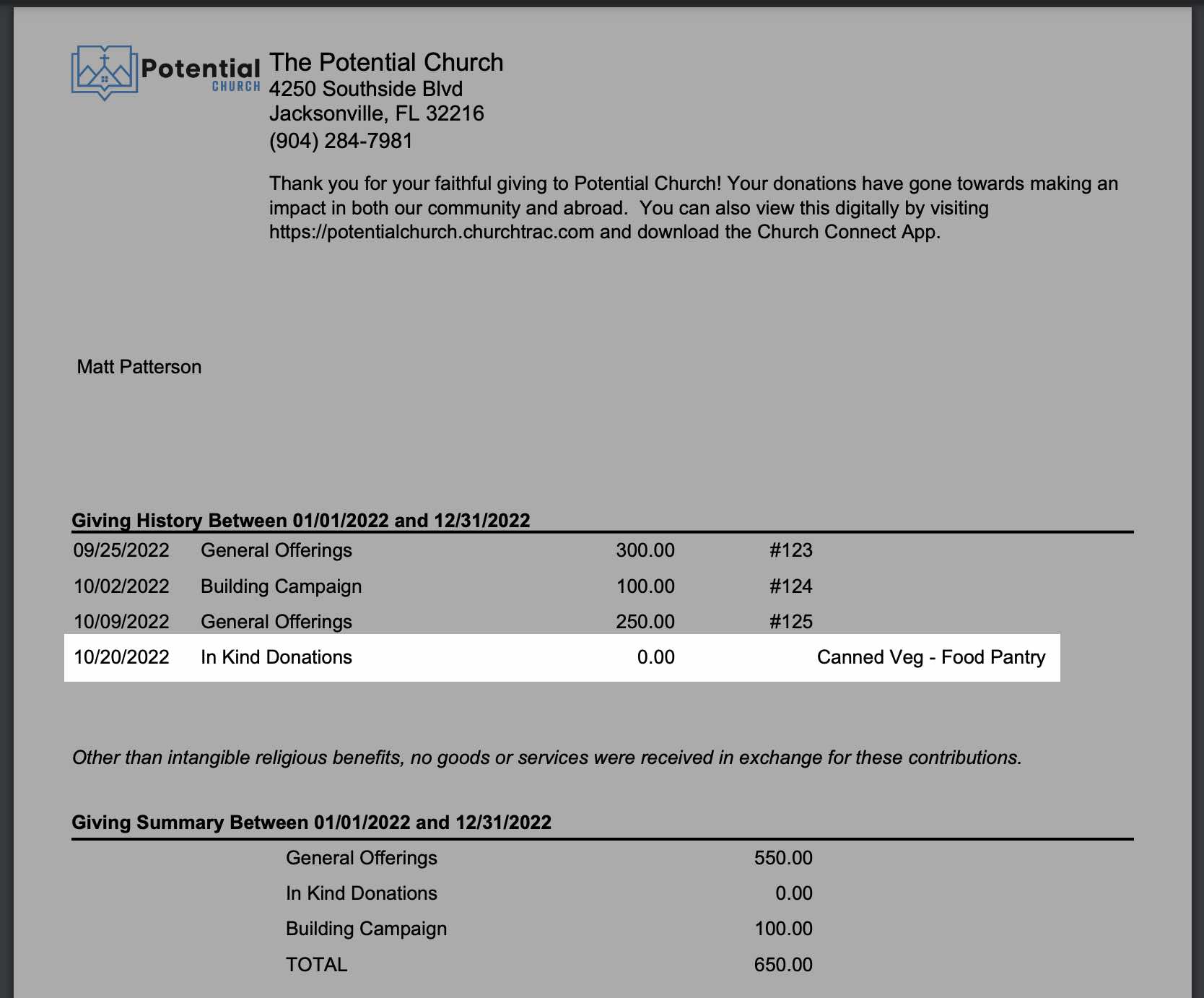

Step 3: Check the Donor's Contribution Statement

Go to the donor's profile in the People screen, then select the "Giving" tab above their profile. Then select the "Family Statement" button in the top-right corner of the screen.

The resulting Contribution Statement will reflect a line item of $0.00 for the donated item, along with a description in the memo line referencing the item.