Using the Register

To access the Account Register for an account, select the name of the account in the Accounts page.

- Using the Register and Entering Transactions

- Creating Giving Deposits

- Printing and Voiding Checks

- Transferring Money Between Funds

- Transferring Money Between Accounts

- Reconciling Transactions

- Recording Payroll Transactions

Using the Register

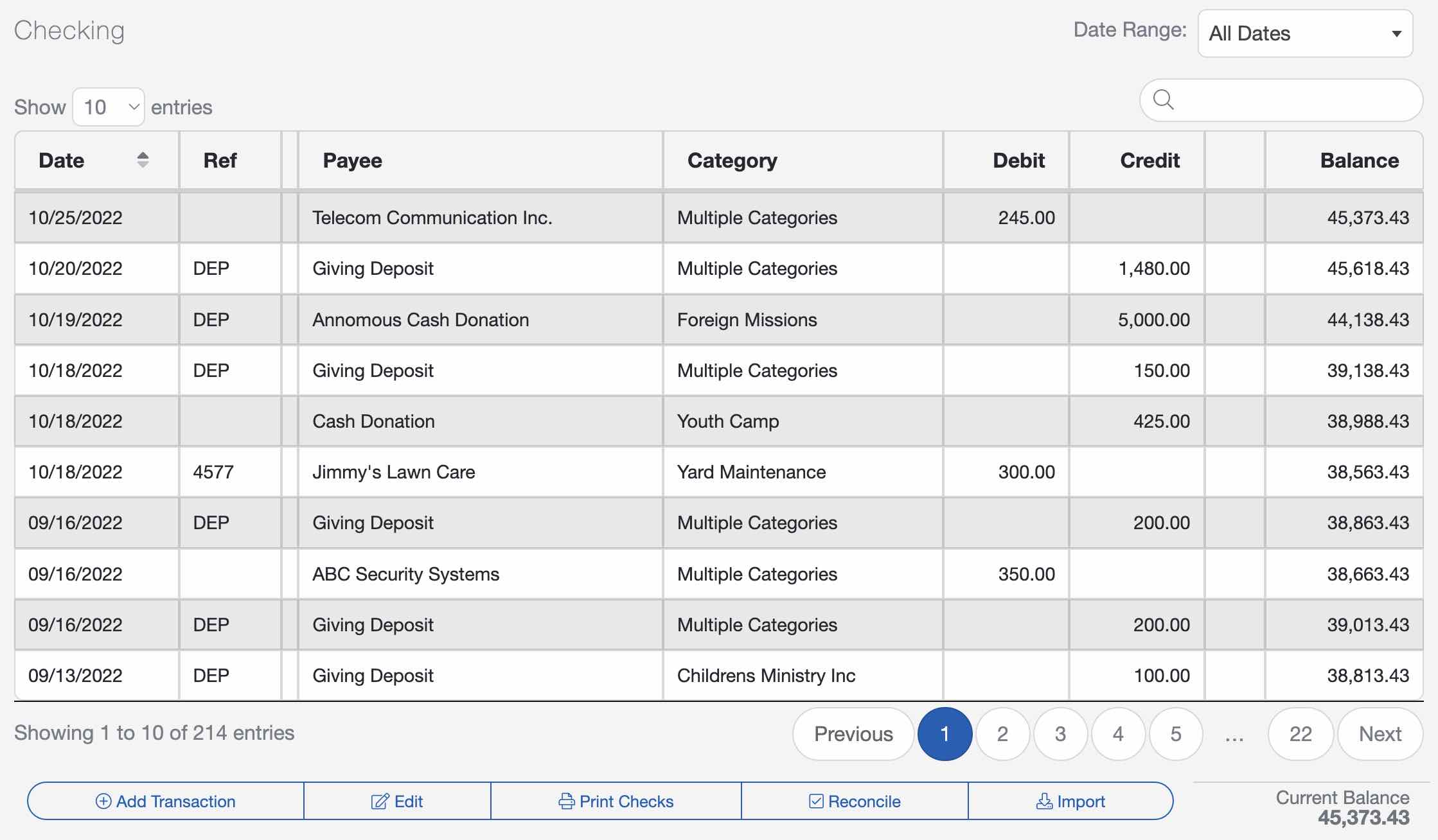

The register works very much like your checkbook register. The register lists all the transactions for a particular account. You enter all your deposits and expenses into the register, but you can also transfer monies between funds and accounts.

The transaction register also gives you the ability to print checks, reconcile your accounts to your bank statements, and record payroll transactions.Your register will continually update your account balance based on the transactions you've entered.

Entering Transactions

To manually create a new transaction, select the "Add Transaction" button at the bottom of the screen.

For each transaction, you should enter a Date, Payee or Description, Transaction Type, Fund, and Amount. The Reference, Note, Memo, Tags and Attached Files fields are optional.

There are four Transactions Types:

- Expense/Charge: Recording bills, payments, and expenditures

- Deposit/Credit: Recording Giving screen deposits, refunds, and church income

- Account Transfer: Moving monies between Accounts

- Fund Transfer: Moving monies between Funds

Here are abbreviations you can choose from in the Reference field:

- Next Check Number: The highest number from your checkbook, plus one

- DEP: Deposit

- TRX: Transfer

- ATM: Automated Teller Machine

- PMT: Payment

- JE: Journal Entry

- ACH: Automated Clearing House (electronic bank payment)

Since this is an open text field, you can also type your own custom reference of your choosing.

To assign a transaction to multiple categories or funds, select the "Add Line" button. Then assign the designated amount to each category and/or fund.

Note

The Note field is intended for internal reference and can be used to record additional details about a transaction (like vouchers). This may include clarifying information or reminders you may want to reference later. Notes are not printed on checks and do not appear on standard accounting reports. Transactions containing Notes can be located using the Accounting → Search tab.

Memo

The Memo field is used for short descriptions that may print on a check. This information appears on printed checks, making it useful for noting the purpose of a payment that a vendor or payee may see. Because the memo must fit on the printed check, this field is limited in length. The Memo field is optional and does not affect standard accounting reports.

Tags

Tags allow you to label or “tag” transactions with simple identifiers, such as “electric” or “lawn service.” Tags are optional and primarily used to help locate transactions later using the Accounting → Search tab. Tags do not replace Categories or Funds and are not used in standard accounting reports.

Importing and Syncing Transactions

There are a few alternatives to manually creating transactions. You can link your bank account directly to your ChurchTrac account or import your transactions directly into the register. Whether importing or syncing bank transactions, you can create Import Rules that help automate the processing and organization of your church's financial transactions.

Creating Giving Deposits

If you are using the Giving screen to track contributions, you'll need to create deposits from the Giving screen for them to show in the Accounting screen. The "Create Deposit" button is only available in the Plus subscription.

Printing and Voiding Checks

ChurchTrac will allow you to print checks either single or printing multiple checks at a time.

Voiding Checks

When it comes to voiding checks, there are 3 common scenarios in which you would want to void a check in ChurchTrac. Learn more about voiding checks ›

Transferring Money Between Funds

Need to transfer money between funds? See our Transferring Money Between Funds article to learn more.

Transferring Money Between Accounts

You can also transfer money between Accounts in ChurchTrac. View our Transferring Money Between Bank Accounts article for further instructions.

Reconciling Transactions

The purpose of reconciling your accounts is to ensure that you can identify any unusual transactions caused by fraud or accounting errors.

Reconcile Transactions

When it comes to tracking your ministry's finances, you want your numbers from the bank to align with what you have entered into ChurchTrac. This is important for having accurate reports and financial transparency. The reconciliation process is your first line of defense against accounting errors and mismanaged funds. We encourage ministries of ALL sizes to reconcile their bank account(s).

Recording Payroll Transactions

Though ChurchTrac is NOT a church payroll platform, you still need to enter your final payroll numbers into the Accounting screen to track your church's finances properly. View our Entering Payroll article for further instructions.