Import Rules

When importing or syncing bank transactions to ChurchTrac Accounting, you have the ability to create import rules.

What are Import Rules?

In Church Accounting Software, rules are a set of customizable guidelines that help automate the processing and organization of your church’s financial transactions. These rules can help save you time and simplify your church bookkeeping.

Creating Import Rules

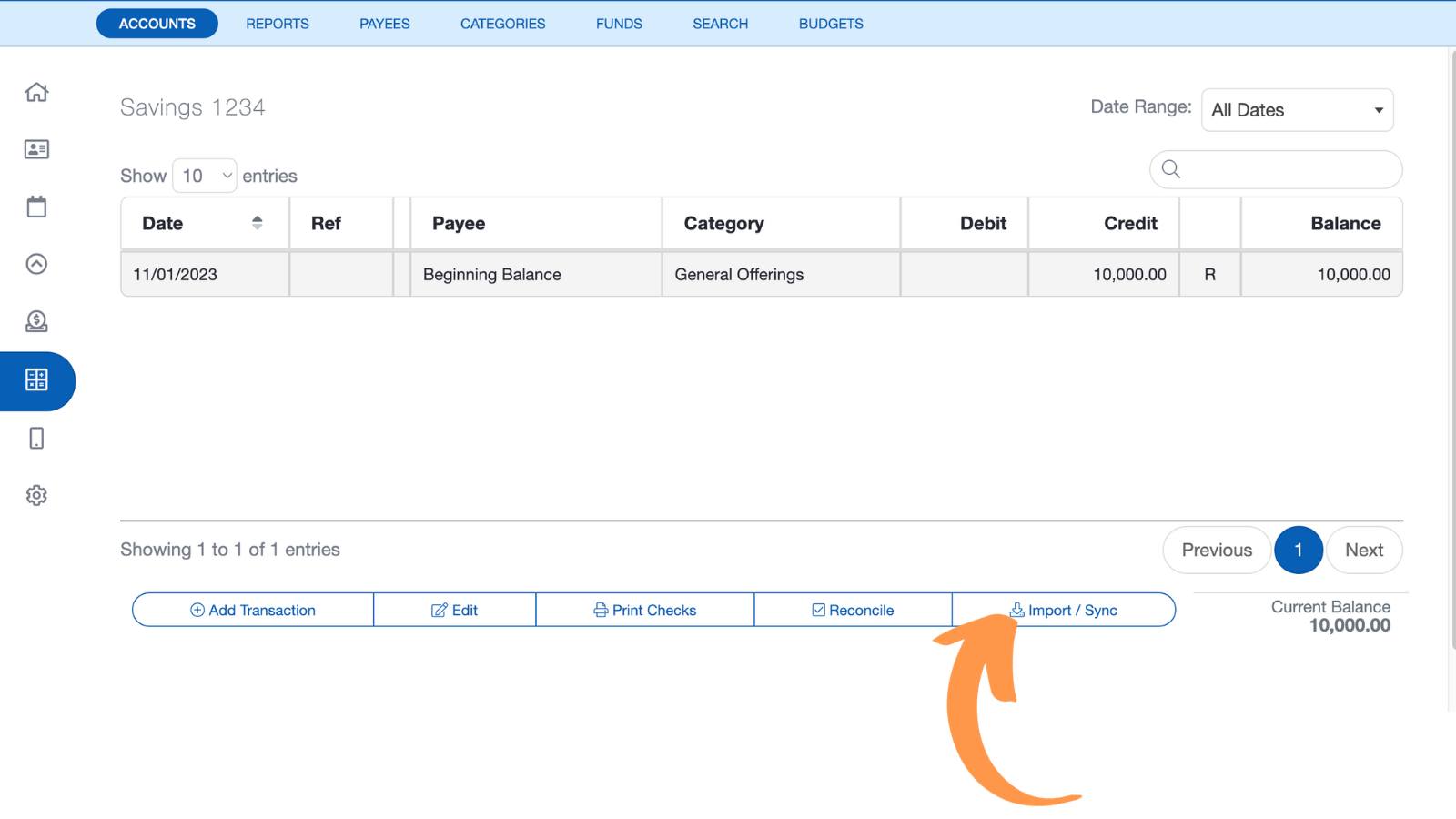

Step 1: From your account register, select "Import/Sync".

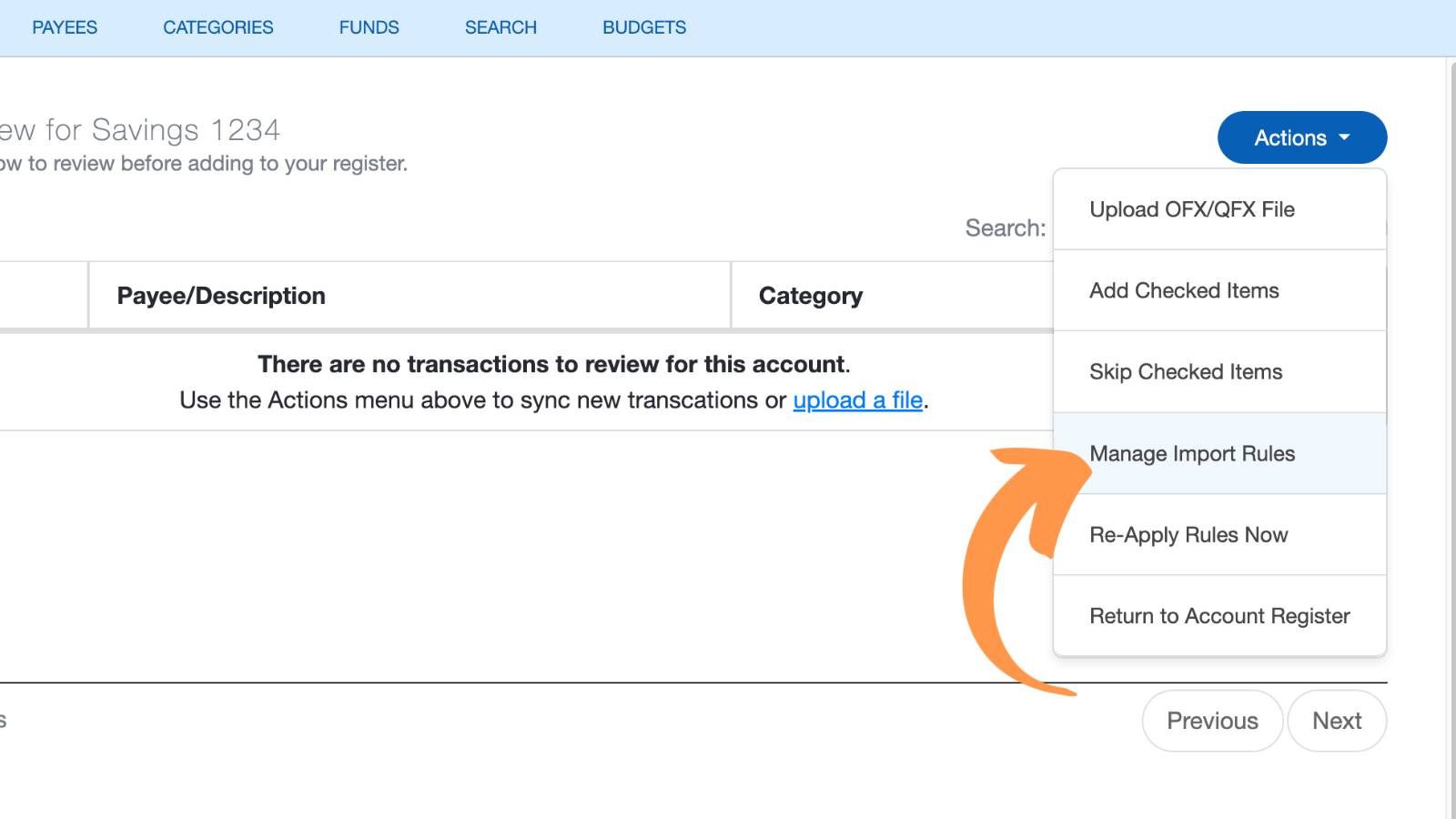

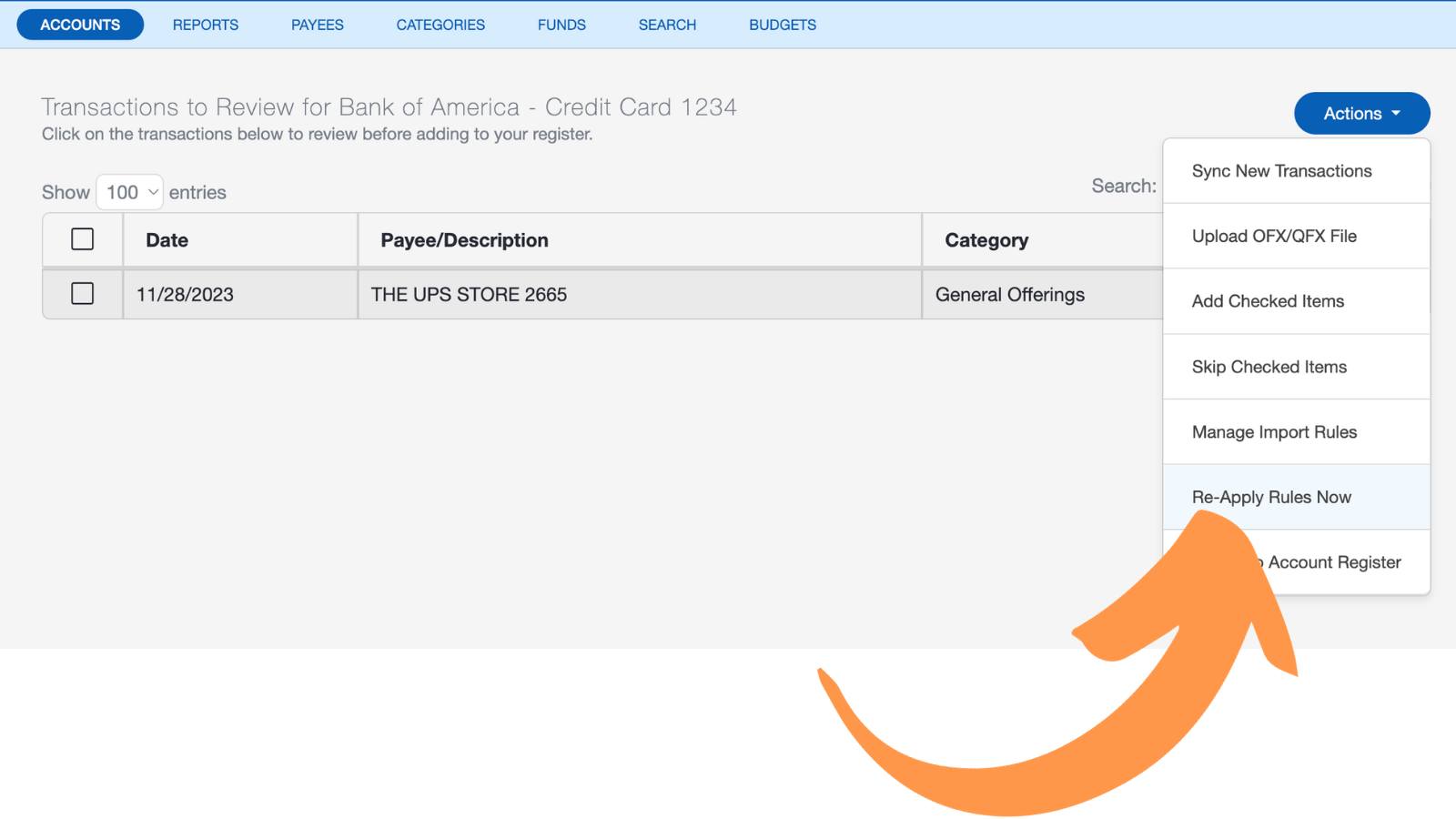

Step 2: On the Import, screen select the Actions button and choose "Manage Import Rules".

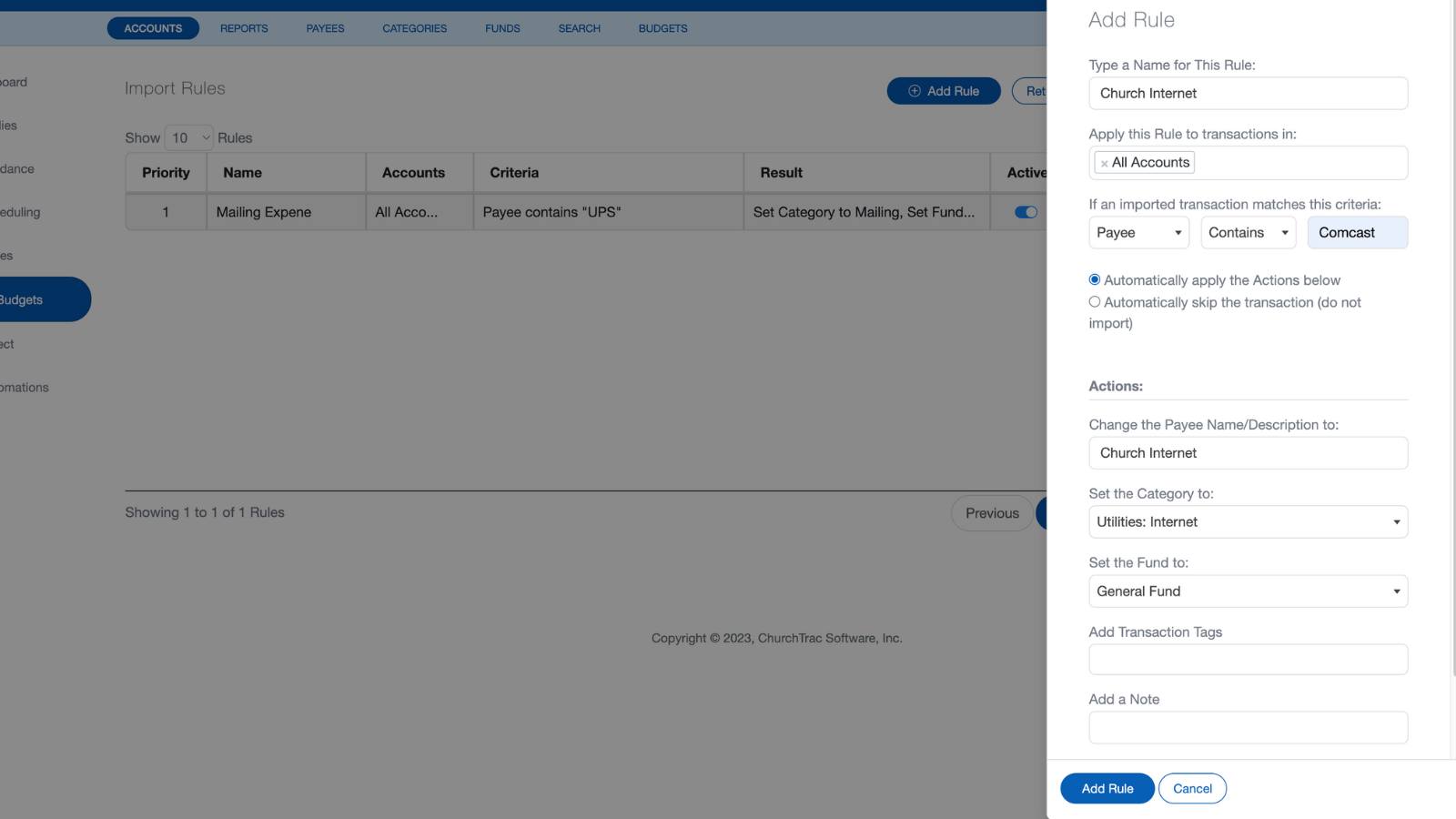

Step 3: Select the "Add Rule" button.

Step 4: Create your rule. Rules can be applied to all accounts or a single account. Rules can update Payee Name/Descriptions, set a Category, set a Fund, and more.

Step 5: Once created, your rule will update transactions that are either imported or synced.

Using Import Rules

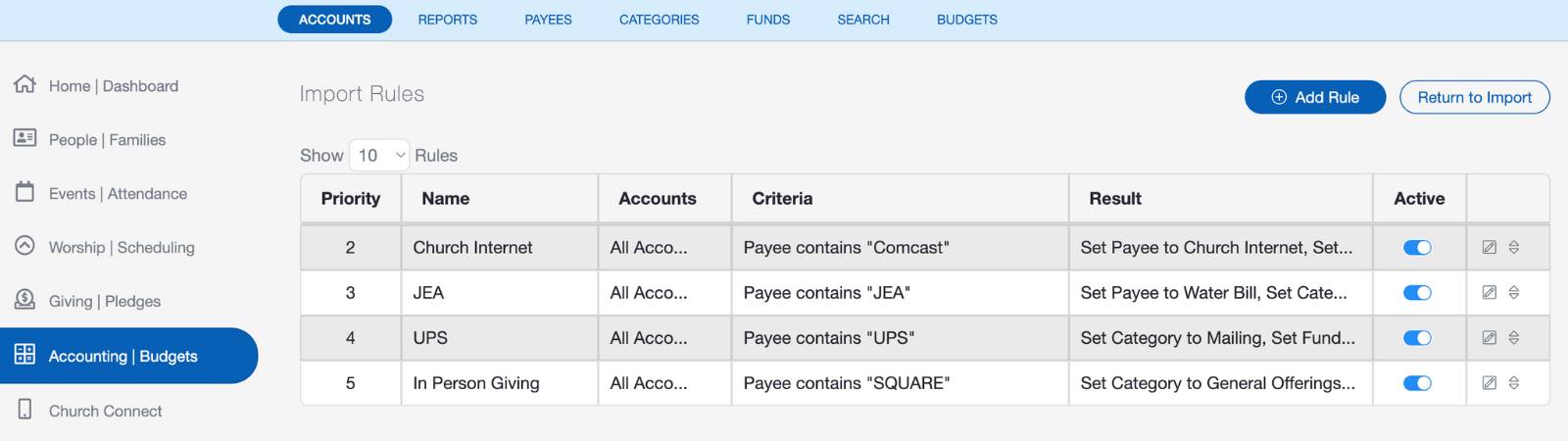

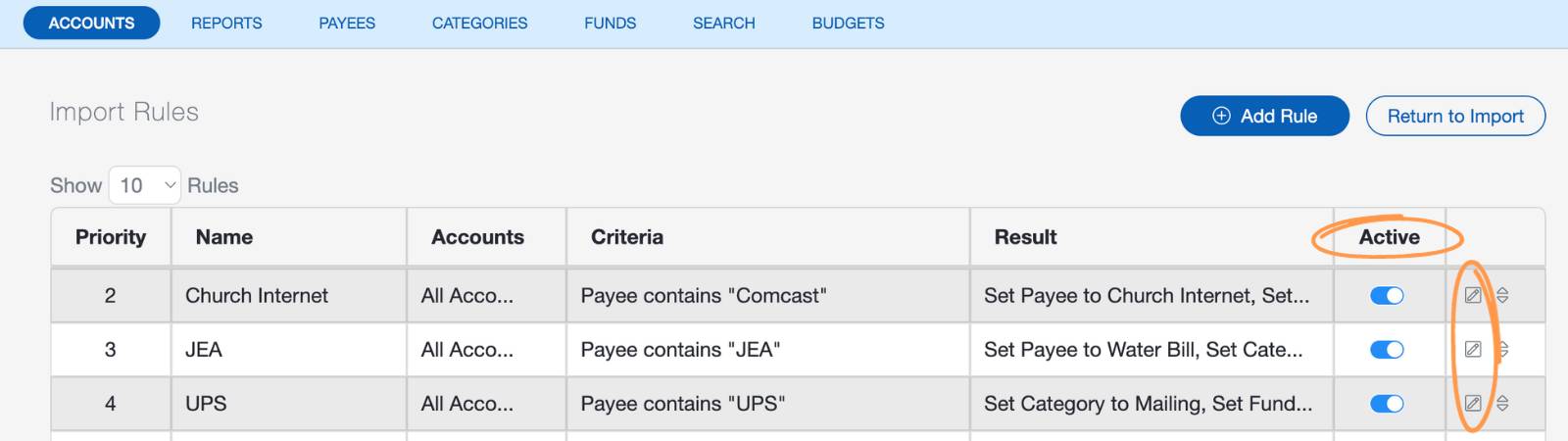

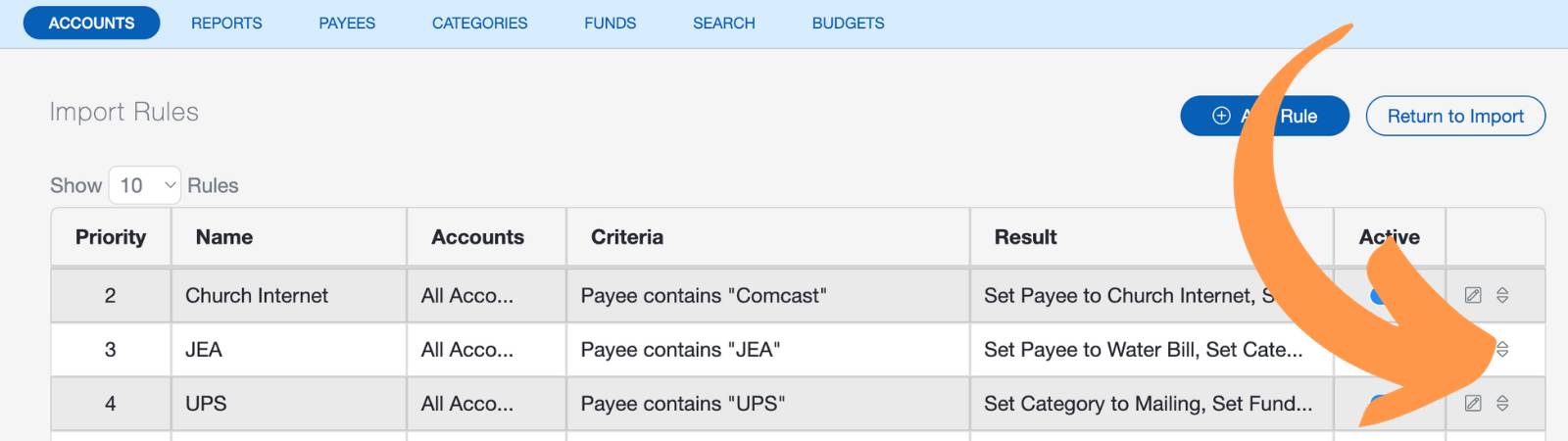

Tip 1: At any time, you can make a rule inactive or edit it by selecting the edit icon.

Tip 2: Rules are sequential from top to bottom. Once a transaction meets the criteria for said rule, the accounting system will apply that rule and move on to the next transaction. For this reason, you can re-order rules to change their priority.

Tip 3: Rules are only applied at the time a bank import/sync. To apply a rule after an import/sync, select "Re-Apply Rules Now" from the Actions button on the Account Import screen.

Import Rules Examples

Using banking import rules has many benefits. Here are a few examples...

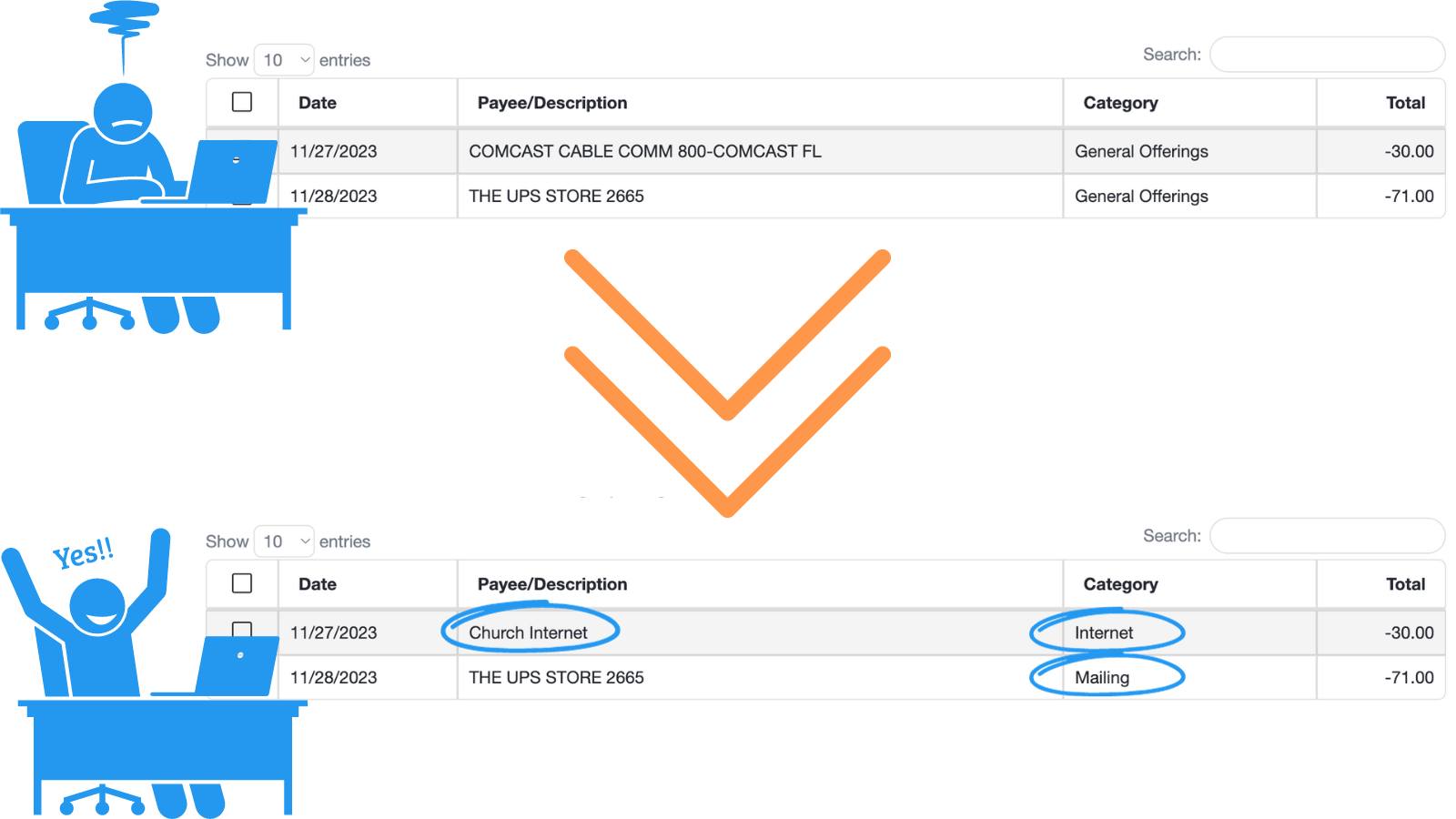

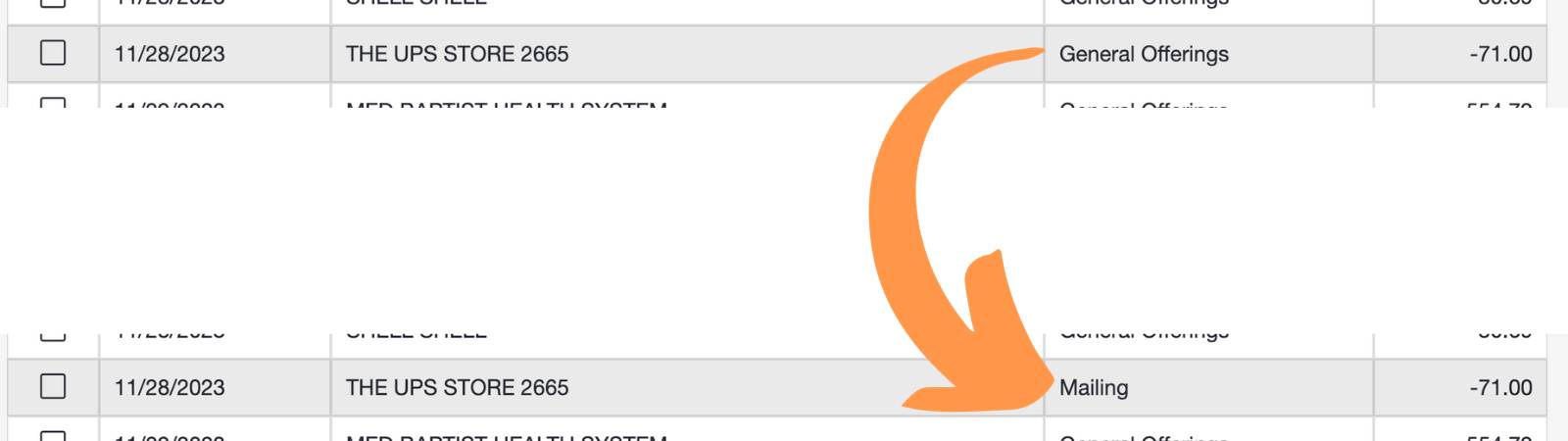

Making transactions more readable

Sometimes, the payee/description provided by banks are borderline unreadable or just frankly unpleasant for church bookkeeping! You can create rules to update these automatically.

Automatically assigning a Category or Fund

Cut down on the time you spend assigning your transactions to various categories or funds.

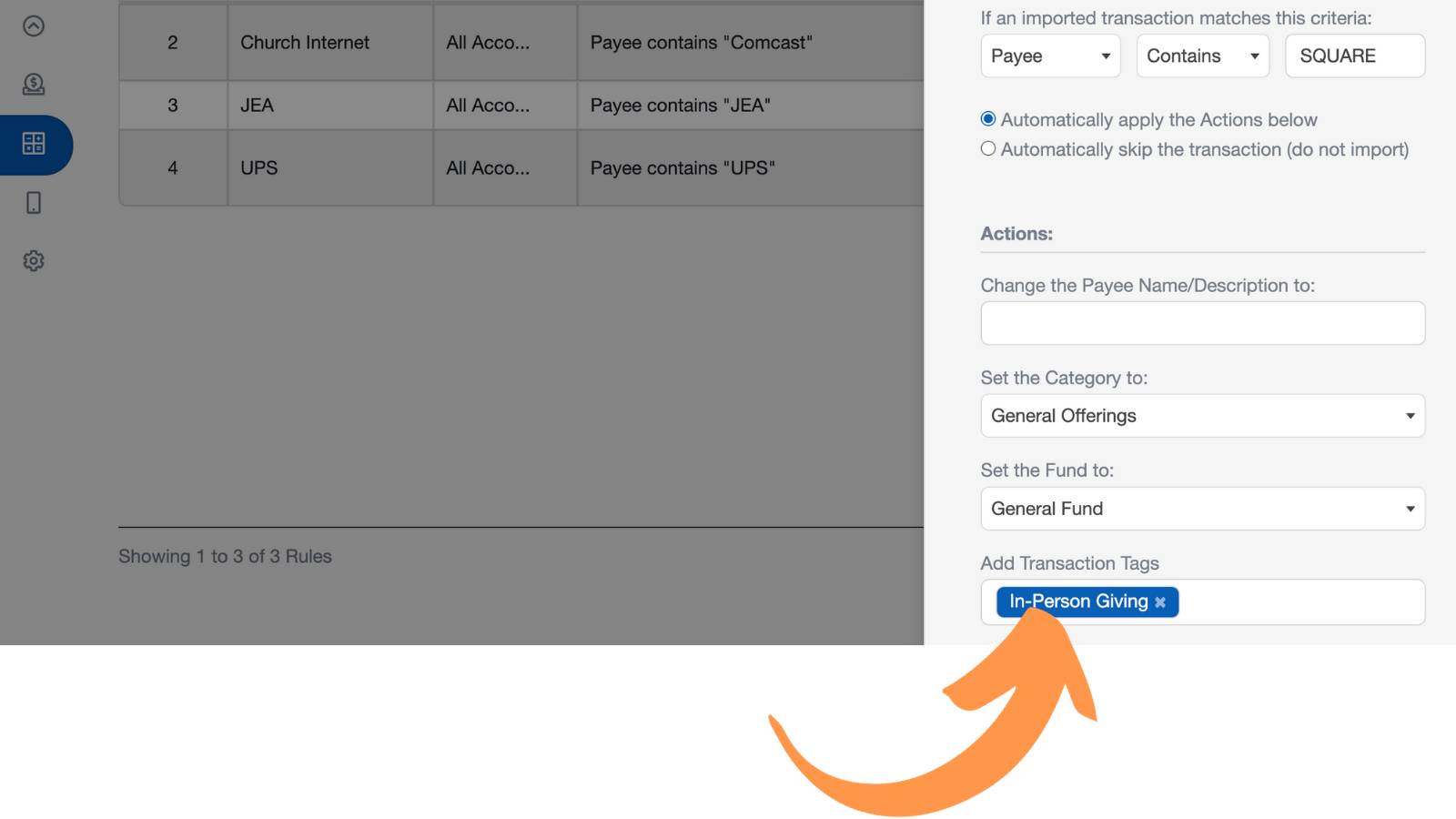

Assigning Transaction Tags

Transaction Tags are very useful in church bookkeeping for specifying income and expenses beyond Categories. These are commonly used for tracking benevolence, missions, and sources of giving.

In the example below, we have a Transaction Tag applied to all in-person giving that comes into the church using the Square giving kiosk.

Watch our helpful Automating Church Expense Tracking Pro Tip video to see this in action.