Should Churches Promote Dave Ramsey's FPU?

Financial Peace University is a powerhouse when it comes to financial know-how, taking charge of your finances, and owning up to personal responsibility. It's no wonder that FPU has been a staple for years in churches across the country!

But...

Is it still a good idea to use Financial Peace University for church members today?

Or are Dave's teachings out of touch and behind the times?

As an FPU graduate, I'll cover why promoting Dave Ramsey for churches can be very beneficial, address causes for concern, and share some FPU alternatives.

Are Dave Ramsey's Financial Teachings Biblical?

Dave Ramsey repeatedly echoes the wisdom of Proverbs 22:7:

Ramsey's primary focus is to help his audience develop better financial habits. Avoiding debt, living within their means, and taking responsibility for their choices are things Dave urges his listeners to do.

Like the Bible, Dave teaches his students to:

- Avoid debt (Proverbs 22:7)

- Build saving (Proverbs 21:20)

- Be generous (2 Corinthians 9:7)

You can trust that your members will come away from Dave Ramsey and FPU with the tools they need to achieve financial freedom.

Let's talk about the pros and cons of Financial Peace University:

Pros of FPU for Churches

Ramsey's Financial Peace University has helped innumerable people get out of debt and enjoy financial freedom. He currently touts 10 million!

If those results don't speak for themselves, below are more reasons to like FPU and consider offering it to your church members:

1. It Follows Biblical Principles

FPU combines sound financial advice with biblical teachings, aligning with your church's values and offering a biblical perspective on managing money.

2. The Steps Are Practical

The 9-week course is more than mere idealism or guilt trips. What I love most about FPU is that Dave and his team are careful to keep everything guilt-free.

The program points students toward actionable steps and practical tools for budgeting, getting out of debt, saving, and investing, empowering everyone to take control of their finances.

3. It Emphasis Stewardship

The Financial Peace University experience focuses heavily on stewardship and personal responsibility.

Not only will members be free from debt (or closer to it), but will also learn how to plan a budget and live within their financial means. They can then build wealth and improve their lives once they grasp their role in managing their money.

4. It Promotes Generosity & Giving

Dave Ramsey constantly encourages a culture of generosity.

The mission of Financial Peace University has more to do with personal finances. Everyone at Ramsey Solutions wants members to gain freedom so they can use their finances to give more to their church and their community.

5. Long-Term Impact

Most people starting FPU are overwhelmed by their financial situation. Ramsey and his team want nothing more than for students to gain control of their finances.

The results speak for themselves. Countless students have paid their debts, learned to avoid bad debt, and have the tools to manage their finances wisely. Testimony after testimony reveals the lifelong impact this creates for anyone who follows the plan.

Below is a powerful example of what one church experienced after hosting Financial Peace University:

6. Financial Literacy & Empowerment

This is a big reason many church leaders consider offering Financial Peace University church courses. We want our members to be freed from bondage of all kinds, especially financial bondage!

A fun 9-week course is a great way to make that happen. The fact that FPU can help build a stronger community among your members is a big bonus.

Cons of Financial Peace University

Financial Peace University has proven to be very effective at helping followers become debt-free. But that doesn't make it the best program for your church.

Below are a few things to consider about the program before offering it to your congregation:

1. Smallest Amount vs High-Interest Debt

Ramsey's Debt Snowball is genius because it leverages human psychology to lead people toward success.

But it's not a mathematically sound approach. His approach means waiting to pay a debt with a higher interest rate later, causing many adherents to pay more overall.

For instance, imagine a member of your church has $7,500 in credit card debt and $5,000 in medical debt. FPU would teach that member to pay the medical debt first, even though that debt doesn't carry interest while the credit card debt has a high interest rate.

2. Credit Cards CAN Be Used Wisely

Contrary to Dave's teaching, credit cards can not only be used wisely but can be financially beneficial.

A credit card can be a great tool for building financial security. As long as members don't carry a monthly balance, they can use a credit card to improve their credit score and even save money with the points they earn.

My coworker (another FPU grad) told me he makes over $1,500 a year in cashback rewards. Like me, he always pays his bill in full and NEVER carries a balance.

A credit card comes with risks, but I think avoiding risks shouldn't be the only goal when managing finances or planning the future.

3. Rigid Approach

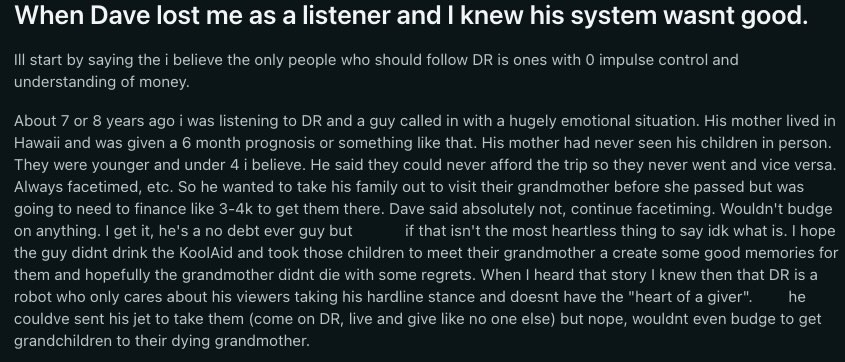

FPU promotes a specific step-by-step plan, which might not accommodate the unique financial situations or needs of all participants, leading to potential frustration or disillusionment. His approach is so rigid, that it leads him to give advice like this:

This gets to a core issue with Ramsey's approach.

Restriction, avoidance, rigidity, and behavioral management are the primary tools he gives to his students to handle their finances. He treats all of his students as if they're former addicts who need a harsh intervention, detox, and rehab, as well as a legalistically rigid approach to debt.

This doesn't give real wisdom or help you learn good habits for managing debt in a healthy way. So instead of helping listeners use credit cards to their advantage (like using a card for the bonuses while never carrying a balance month to month), he simply tells everyone to throw them away.

4. Questionable Investment Advice

Dave Ramsey has an odd understanding of mutual funds that doesn't quite line up with reality. At best, how he talks about and promotes mutual funds is outdated. Your members might be better off investing in index funds instead.

On top of that, FPU also advocates that followers hold off on retirement savings until Baby Step 4! That means your members would be leaving free money on the table from their IRA or 401k matching at work. Passing up free money from an employer is just downright silly.

5. Long-Term Sustainability

Depending on how much debt a member has or how much income they make, Baby Step 2 could take years!

Ramsey and his team are adamant that followers do not deviate from the steps or try to come up with their own strategy, meaning some of your members will feel stuck.

Some members may need a more nuanced approach. If their circumstances don't match the methods in FPU, they'll either be stuck following a plan that isn't best for them or feeling frustrated and discouraged when things don't work out.

6. Huge Emergency Fund Risks

Ramsey teaches that people should set $1000 aside in an emergency fund as their first step. This is a great start.

But he then advises to pay all debt before building that emergency fund further.

Unless a member has a very small amount of debt, this is incredibly risky and could lead to members feeling like they're always losing progress. If an emergency happens as they're working on Baby Step 2, the member will have to halt their progress and return to Step 1 before continuing, which can feel discouraging.

Not to mention, $1000 isn't enough to cover most emergencies! Hopefully, the team at Ramsey Solutions will update that emergency fund amount to be up with the times...

7. FPU Is NOT for Everyone

If a member is living beneath (or only slightly above) the poverty line, FPU will be of little help to them. Their financial needs are beyond the scope of the program.

FPU's target demographic is people who make a comfortable income, but who have poorly managed their money and are overwhelmed by debt. But as many testimonies indicate, most adherents succeeded by simply working a part-time second job for a few months and following the Debt Snowball approach. If that's all they needed, they were already financially well off to start.

Your low-income members won't benefit from FPU's baby steps. Some will not be able to achieve Baby Step 1, much less pay down their debts.

Financial Peace University, for all of its many benefits, will leave some of your members in its dust.

My Experience with Financial Peace University

My wife and I took Financial Peace University over 10 years ago as part of our premarital counseling.

Debt avoidance was ingrained in us as we started a new life together and I couldn't be more thankful to Dave Ramsey for those lessons. We've avoided several poor financial decisions because of it. It is a foundational part of my personal finance.

But I have not followed FPU's advice to the letter and have not listened to Dave Ramsey in many years.

That's because the best advice Dave has to offer is everything regarding avoiding bad debt and living within a budget. Once we grasped that, we didn't feel the rest of his advice fit our needs. We've grown beyond what Financial Peace University has to offer.

For instance, we...

- Use a credit card to build good credit

- Don't follow his investment advice

- Set money aside for retirement no matter what our finances look like

I've learned that it's okay to take Ramsey's advice that works for us and search for others that meet our needs.

Financial Peace University Alternatives for Churches

Financial Peace University isn't the only name in the game. Below are a few excellent FPU alternatives for churches:

- You Need A Budget (YNAB) - YNAB is an easy-to-use app that helps users not just budget, but build healthy financial habits.

- Clark Howard - Like Dave Ramsey, Howard has a top-rated podcast and is a best-selling author. Many prefer him over others because his approach is less extreme and helps listeners feel they can still live their lives as they gain control of their finances.

- Ramit Sethi - Ramit helps his followers do more than just get out of debt, but also plan their financial future and take steps toward that future.

- A Certified Financial Planner - If a member of your congregation is a certified financial counselor, it may be best to hire them to coach your members on their finances instead of relying on an outside source.

It would be worthwhile to present these options to your congregation and get feedback on which they feel is right.

Is Financial Peace University for Churches Worth It?

FPU has helped millions of people get out of debt and develop better financial habits. The message and community behind Ramsey Solutions is something that I think most churches will resonate with and benefit from.

It provides the framework and resources churches need. Especially smaller churches and ministries with limited resources.

But if your church has the resources and qualified members to teach financial literacy, you should really consider doing your own thing.

Financial education, when done right, is a valuable tool for spiritual and communal growth!

|

Matt

|