Switching from QuickBooks

Whether you're switching from QuickBooks to ChurchTrac or just considering it, moving to our accounting software is easier than you think. This guide will walk you through the key differences and provide step-by-step instructions for a smooth transition.

Understanding the Difference

Unlike QuickBooks, which is built for businesses, ChurchTrac's fund-based accounting is designed specifically for churches and nonprofits. Learn more about Single Entry vs Double Entry ›

Some key differences include:

Best for...

Churches and ministries needing simple, church-focused accounting.

Uses Categories to identify or designate how money is received (income) or spent (expense).

Represents real financial accounts like a checkings and savings (asset) and credit cards (liability).

Uses an Income Statement for fund-based accounting, which serves the same purpose as a profit and loss statement.

Single-entry, cash-based, like a checkbook.

Designed for fund-based accounting, designated giving, and ministry needs.

Affordable, all-in-one church solution.

Best for...

Businesses needing advanced financial tools.

Uses a Chart of Accounts for business-style accounting.

The chart of accounts lists all your accounts and their balances. QuickBooks uses this list to track funds, debts, money coming in, and money going out.

Uses a Profit & Loss Statement to track profitability.

Double-entry, requiring debits and credits.

Built for businesses, requiring workarounds for church accounting.

Higher subscription fees.

Switching from QuickBooks

If you’re wondering what’s next after switching or how to make the move smoothly, this guide will walk you through the process, ensuring you’re set up for success. Learn more about Setting Up Accounting in ChurchTrac ›

Step 1: Export Your Data from QuickBooks

Before making the switch, save important financial records like your Balance Sheet, Income Statement, and Transaction Reports. This will help you carry over accurate starting balances and financial history.

Step 2: Set Up Your Funds in ChurchTrac

ChurchTrac uses fund-based accounting, meaning money is tracked based on purpose—not just income and expenses. Go to the Accounting screen, and select the "Funds" tab. Create funds for all your designated giving (i.e. General Fund, Missions, Building Fund). Learn more about Funds ›

Step 3: Configure Your Categories

Instead of a traditional chart of accounts, ChurchTrac uses Categories to track income and expenses. Customize them to match your ministry’s financial needs. Learn more about Categories ›

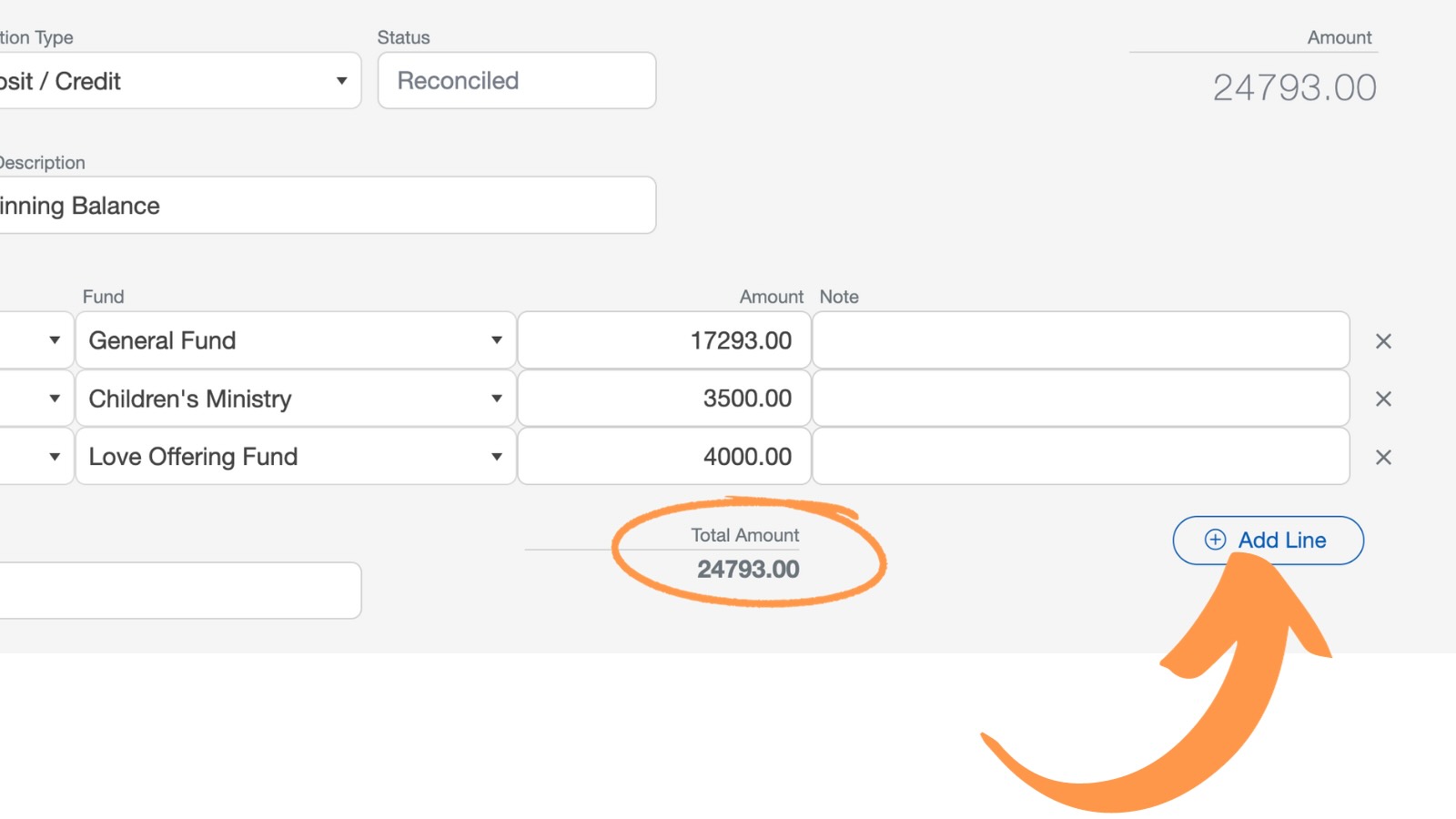

Step 4: Enter Your Beginning Balances

Bring in previous balances from QuickBooks to ensure continuity. Use your exported reports to manually enter starting balances for funds and accounts. Learn more about Accounts ›

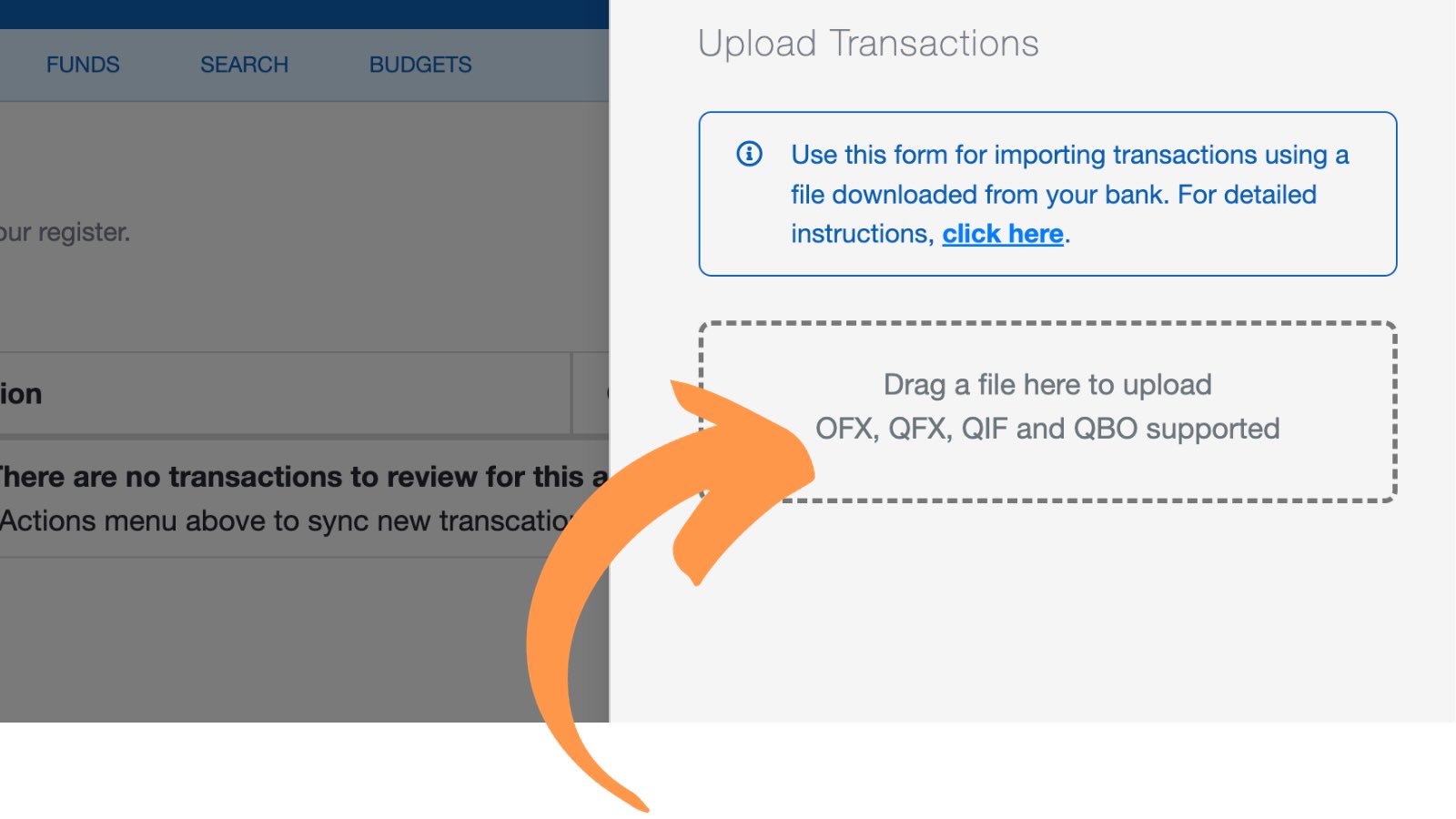

Step 5: Import Your Transactions to ChurchTrac

After setting up your beginning balances, you can start importing your transactions.

It's important to note, that ChurchTrac is not directly compatible with QuickBooks, meaning you cannot import transactions directly from QuickBooks into ChurchTrac. However, you can still import your bank transactions using files provided by your bank or financial institution.

You can upload transactions using an OFX (Money), QFX (Quicken), QIF, or QBO (QuickBooks) file from your bank. Simply select a bank account in ChurchTrac, choose the "Import/Sync" option, and upload your file to categorize your transactions. Learn more about Importing Transactions ›

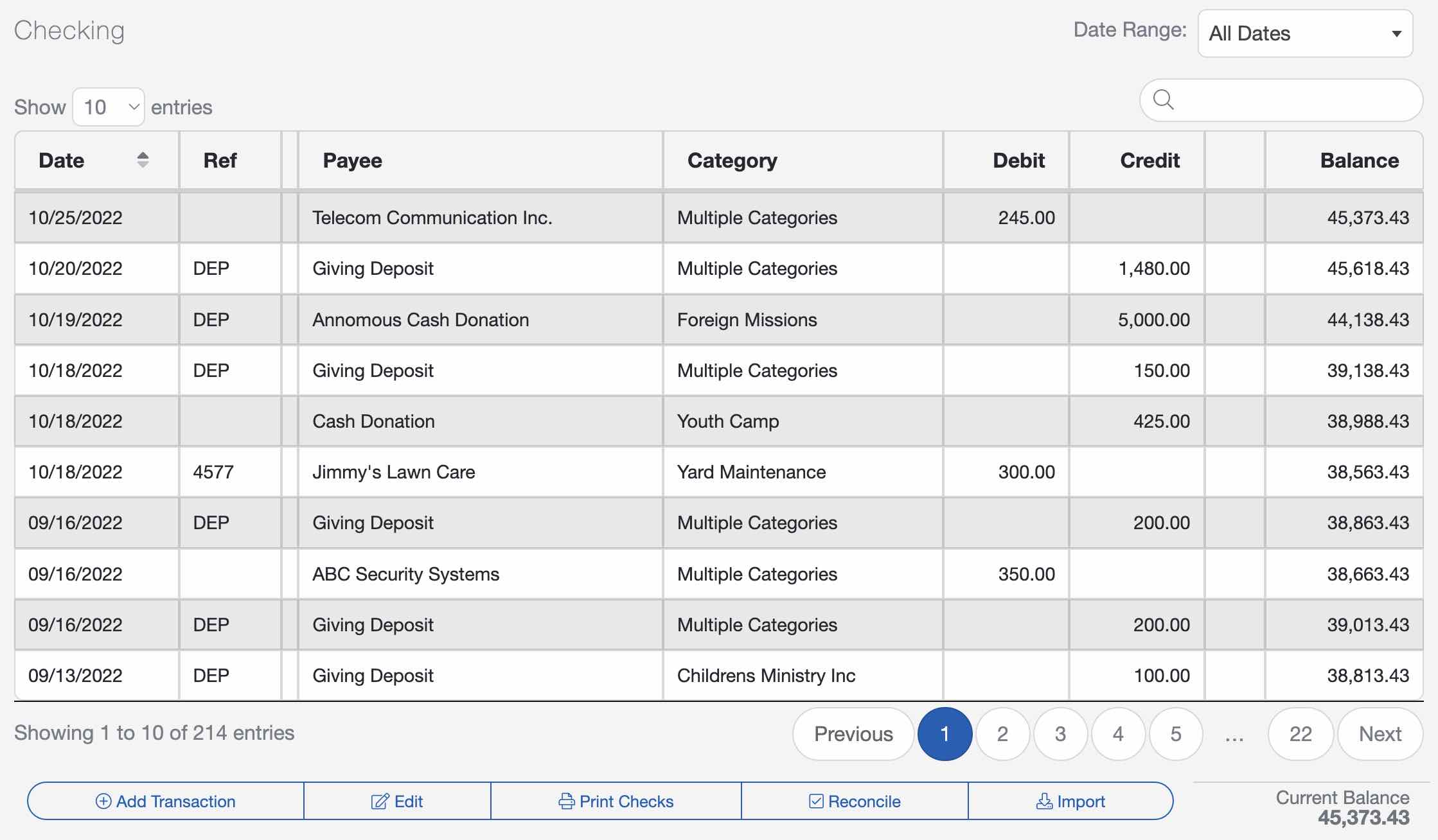

Step 6: Start Tracking Transactions

Now you’re ready to start recording giving and tracking expenses! Assign transactions to the appropriate fund and category to maintain clear financial records. Learn more about Using the Register ›

FAQs

ChurchTrac is not directly compatible with QuickBooks, meaning you cannot import transactions directly from QuickBooks into ChurchTrac. However, you can still import your bank transactions using files provided by your bank or financial institution. You can upload transactions using an OFX (Money), QFX (Quicken), QIF, or QBO (QuickBooks) file from your bank. Simply select a bank account in ChurchTrac, choose the "Import/Sync" option, and upload your file to categorize your transactions. Learn more about Importing Transactions ›

ChurchTrac uses Categories to track income and expenses, simplifying bookkeeping. QuickBooks uses a Chart of Accounts, which is more complex, business-focused. Accounts in ChurchTrac are actual bank accounts.

ChurchTrac uses Expense Categories to assign how a bill is paid. In contrast, QuickBooks uses Liability Accounts to hold the money to pay the bills.

Bring in previous balances from QuickBooks to ensure continuity. Use your exported reports to manually enter starting balances for funds and accounts.. Learn more about Accounts ›

Yes! ChurchTrac allows you to reconcile transactions with your bank statements to ensure accuracy. Learn more about Reconciling Bank Accounts ›

No, ChurchTrac does not have built-in payroll. However, you can track payroll expenses by assigning them to an expense category. Learn more about Entering Payroll ›

Yes. Instead of a Profit & Loss Statement, you’ll use the Income Statement to track fund-based finances. ChurchTrac also provides church-specific reports like Giving Statements. Learn more about Accounting Reports ›

Yes! ChurchTrac is designed for churches, offering accounting features at a much lower cost than QuickBooks.

ChurchTrac does not generate tax documents like invoices, 1099s, etc. However, we do provide Giving Statements for members.

ChurchTrac Accounting is designed for the needs of small to midsized churches. If you're in a larger church, you may need additional accounting tools.